Introduction

THROUGH DECADES, BANKING HAS EVOLVED DRAMATICALLY, PUSHING PAST TRADITIONAL BOUNDARIES AND EMBRACING DIGITAL INNOVATIONS THAT ONCE WERE UNIMAGINABLE. AS A CORNERSTONE OF THE ECONOMY, BANKS MOBILISE RESOURCES, SECURE TRANSACTIONS, AND EXTEND CREDIT, FOSTERING ECONOMIC GROWTH AND STABILITY. THEY HOLD A VITAL POSITION OF TRUST, SAFEGUARDING PUBLIC WEALTH AND ENSURING THE CONTINUOUS DEVELOPMENT OF BANKING AND FINANCIAL SERVICES.

Driving sustainable

growth

This remarkable performance was registered despite various headwinds impacting the BFSI sector. I would also like to briefly touch upon the various challenges faced and opportunities presented for the Bank during the year. First, on the macroeconomic front, high inflation levels at the commencement of the financial year, especially food inflation, had prompted the government to take various supply-side measures. The RBI, on the other hand, postponed the withdrawal of accommodation to ensure that inflation progressively aligns to the target while supporting growth.

Mr. B. A. Prabhakar

Chairman

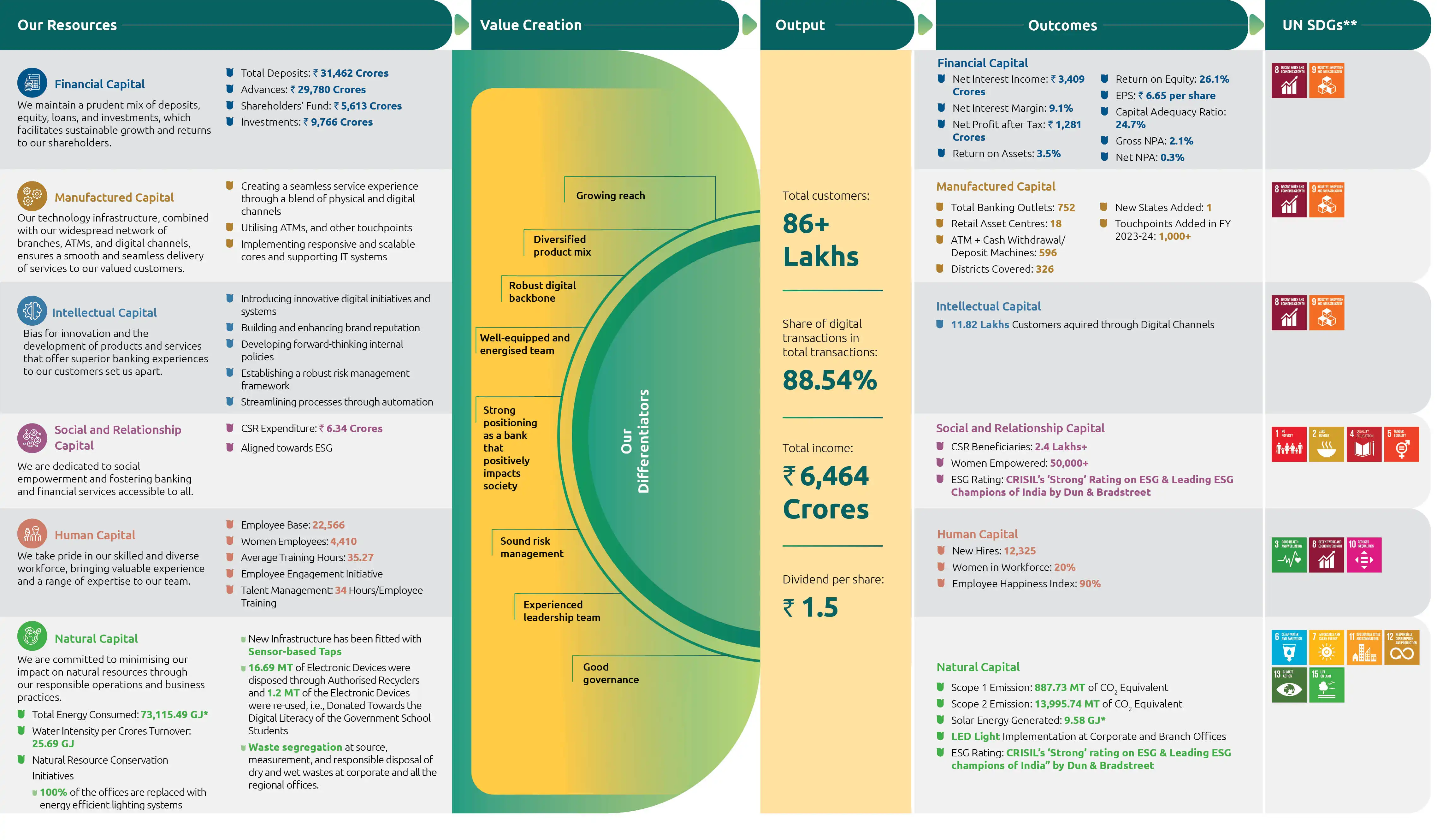

MEASURING OUR SUSTAINABLE GROWTH

CONSISTENCY SERVES AS THE BEDROCK OF OUR STRONG PERFORMANCE, PROVIDING A RELIABLE FOUNDATION FOR ASSESSING OUR PROGRESS AND IMPACT. THIS CHAPTER DELVES INTO THE METRICS THAT ILLUSTRATE OUR COMMITMENT TO SUSTAINABLE GROWTH AND FINANCIAL STABILITY.

-

Delivering Profitable Growth

-

Strengthening Balance Sheet

-

Improving Key Ratios

-

Enhancing Asset Quality and Stability

₹ 6,464 Crores

Total Income

36% YoY

₹ 1,917 Crores

Pre-Provision Operating Profit

29% YoY

₹ 1,281 Crores

PAT

17% YoY

₹ 6.65

Earnings Per Share

₹ 40,422 Crores

Balance Sheet Size

21% YoY

₹ 23,389 Crores

Disbursements

17% YoY

₹ 29,780 Crores

Gross Loan Book

24% YoY

₹ 31,462 Crores

Total Deposits

23% YoY

₹ 13,750 Crores

Retail Term Deposit

36% YoY

₹ 3,409 Crores

Net Interest Income

26% YoY

3.5%

Return on Assets

26.1%

Return on Equity

9.1%

Net Interest Margin

54%

Cost Income Ratio

87%

Provision Coverage Ratio

24.7%

Capital Adequacy Ratio

2.1%

Gross NPA

0.3%

Net NPA

BPS 23

0.58%

Credit Cost

BPS 52

MAKING STEADY STRIDES

CONSISTENCY SERVES AS THE BEDROCK OF OUR STRONG PERFORMANCE, PROVIDING A RELIABLE FOUNDATION FOR ASSESSING OUR PROGRESS AND IMPACT. THIS CHAPTER DELVES INTO THE METRICS THAT ILLUSTRATE OUR COMMITMENT TO SUSTAINABLE GROWTH AND FINANCIAL STABILITY.

-

Best of Our Operational

-

Best of Our Environmental

-

Best of Our People

-

Best of Our Community

-

Best of Our Governance

99%

COLLECTION EFFICIENCY (Upto 1 EMI)

9.1 Lakhs

NEW CUSTOMERS ADDED

10,400

LEADS GENERATED PER MONTH (PHONE BANKING)

₹ 31,462 Crores

REMARKABLE MILESTONE IN OUR DEPOSITS

123

NEW BRANCHES ADDED IN OUR NETWORK DURING FY 2023-24

₹ 3,554 Crores

RAISED FROM IBPC

100%

OFFICES EQUIPPED WITH ENERGY EFFICIENT LIGHTING

₹ 2.3

EMISSION INTENSITY (TONNES CO2 EQUIVALENT PER CRORE TURNOVER)

1.2 MT

OF REFURBISHED ELECTRONIC DEVICES CONTRIBUTED FOR EDUCATIONAL PURPOSES

24% YoY

Top 25

‘INDIA'S BEST WORKPLACESTM’ IN BFSI INDUSTRY 2023

Top 50

‘INDIA'S BEST WORKPLACESTM’ FOR CULTURE AND INNOVATION 2023

Top 100

‘INDIA'S BEST WORKPLACESTM’ FOR WOMEN 2023 (LARGE)

Top 50

‘GREAT PLACE TO WORKTM’ IN GENERAL CATEGORY

2,507

NEW WOMEN EMPLOYEES HIRED (DOUBLE FOLD INCREASE FROM FY 2022-23) OUT OF WHICH 349 WOMEN WERE UNDER ‘UNPAUSE INITIATIVE’

20

DIFFERENTLY ABLED EMPLOYEES AS ON MARCH 31, 2024

2.1%

Gross NPA

0.3%

Net NPA

BPS 23

0.58%

Credit Cost

BPS 52

₹ 6.34 Crores

CSR EXPENDITURE

2.4 Lakhs+

TOTAL BENEFICIARIES

50,000+

WOMEN EMPOWERED

ENSURING STEADY

AND STABLE GROWTH

₹ 6,464 Crores

Total Income

36% YoY

₹ 1,917 Crores

Pre-Provision Operating Profit

29% YoY

₹ 1,281 Crores

PAT

17% YoY

₹ 6.65

Earnings Per Share

₹ 40,422 Crores

Balance Sheet Size

21% YoY

₹ 23,389 Crores

Disbursements

17% YoY

₹ 29,780 Crores

Gross Loan Book

24% YoY

₹ 31,462 Crores

Total Deposits

23% YoY

₹ 13,750 Crores

Retail Term Deposit

36% YoY

₹ 3,409 Crores

Net Interest Income

26% YoY

3.5%

Return on Assets

26.1%

Return on Equity

9.1%

Net Interest Margin

54%

Cost Income Ratio

87%

Provision Coverage Ratio

24.7%

Capital Adequacy Ratio

2.1%

Gross NPA

0.3%

Net NPA

BPS 23

0.58%

Credit Cost

BPS 52

99%

COLLECTION EFFICIENCY (Upto 1 EMI)

9.1 Lakhs

NEW CUSTOMERS ADDED

10,400

LEADS GENERATED PER MONTH (PHONE BANKING)

₹ 31,462 Crores

REMARKABLE MILESTONE IN OUR DEPOSITS

123

NEW BRANCHES ADDED IN OUR NETWORK DURING FY 2023-24

₹ 3,554 Crores

RAISED FROM IBPC

100%

OFFICES EQUIPPED WITH ENERGY EFFICIENT LIGHTING

₹ 2.3

EMISSION INTENSITY (TONNES CO2 EQUIVALENT PER CRORE TURNOVER)

1.2 MT

OF REFURBISHED ELECTRONIC DEVICES CONTRIBUTED FOR EDUCATIONAL PURPOSES

24% YoY

Top 25

‘INDIA'S BEST WORKPLACESTM’ IN BFSI INDUSTRY 2023

Top 50

‘INDIA'S BEST WORKPLACESTM’ FOR CULTURE AND INNOVATION 2023

Top 100

‘INDIA'S BEST WORKPLACESTM’ FOR WOMEN 2023 (LARGE)

Top 50

‘GREAT PLACE TO WORKTM’ IN GENERAL CATEGORY

2,507

NEW WOMEN EMPLOYEES HIRED (DOUBLE FOLD INCREASE FROM FY 2022-23) OUT OF WHICH 349 WOMEN WERE UNDER ‘UNPAUSE INITIATIVE’

20

DIFFERENTLY ABLED EMPLOYEES AS ON MARCH 31, 2024

2.1%

Gross NPA

0.3%

Net NPA

BPS 23

0.58%

Credit Cost

BPS 52

₹ 6.34 Crores

CSR EXPENDITURE

2.4 Lakhs+

TOTAL BENEFICIARIES

50,000+

WOMEN EMPOWERED

ENSURING STEADY

AND STABLE GROWTH

THRIVING FOR TRANSFORMATIVE IDEAS

Mr. Ittira Davis

MD & CEO (w.e.f. January 14, 2022 to June 30, 2024)

FY 2023-24 has been also a year of consolidation. While scaling new highs, we also have successfully completed the merger process between the Bank and its Holding company. I would like to highlight that the merger has benefitted all our shareholders. The Bank is one strong listed entity, merger has benefitted book value per share to increase by ₹ 2.6 to ₹ 29.

READY FOR THE NEW

Mr. Sanjeev Nautiyal

MD & CEO (w.e.f. July 01, 2024)

Joining Ujjivan SFB is truly an honour, as its mission resonates deeply with my values. The commitment to becoming a leading mass-market bank, rooted in the philosophy of enhancing lives, speaks volumes about the organisation's dedication to inclusivity and progress.

THRIVING FOR TRANSFORMATIVE IDEAS

Mr. Ittira Davis

MD & CEO (w.e.f. January 14, 2022 to June 30, 2024)

FY 2023-24 has been also a year of consolidation. While scaling new highs, we also have successfully completed the merger process between the Bank and its Holding company. I would like to highlight that the merger has benefitted all our shareholders. The Bank is one strong listed entity, merger has benefitted book value per share to increase by ₹ 2.6 to ₹ 29.

READY FOR THE NEW

Mr. Sanjeev Nautiyal

President MD & CEO (w.e.f. July 01, 2024)

Joining Ujjivan SFB is truly an honour, as its mission resonates deeply with my values. The commitment to becoming a leading mass-market bank, rooted in the philosophy of enhancing lives, speaks volumes about the organisation's dedication to inclusivity and progress.

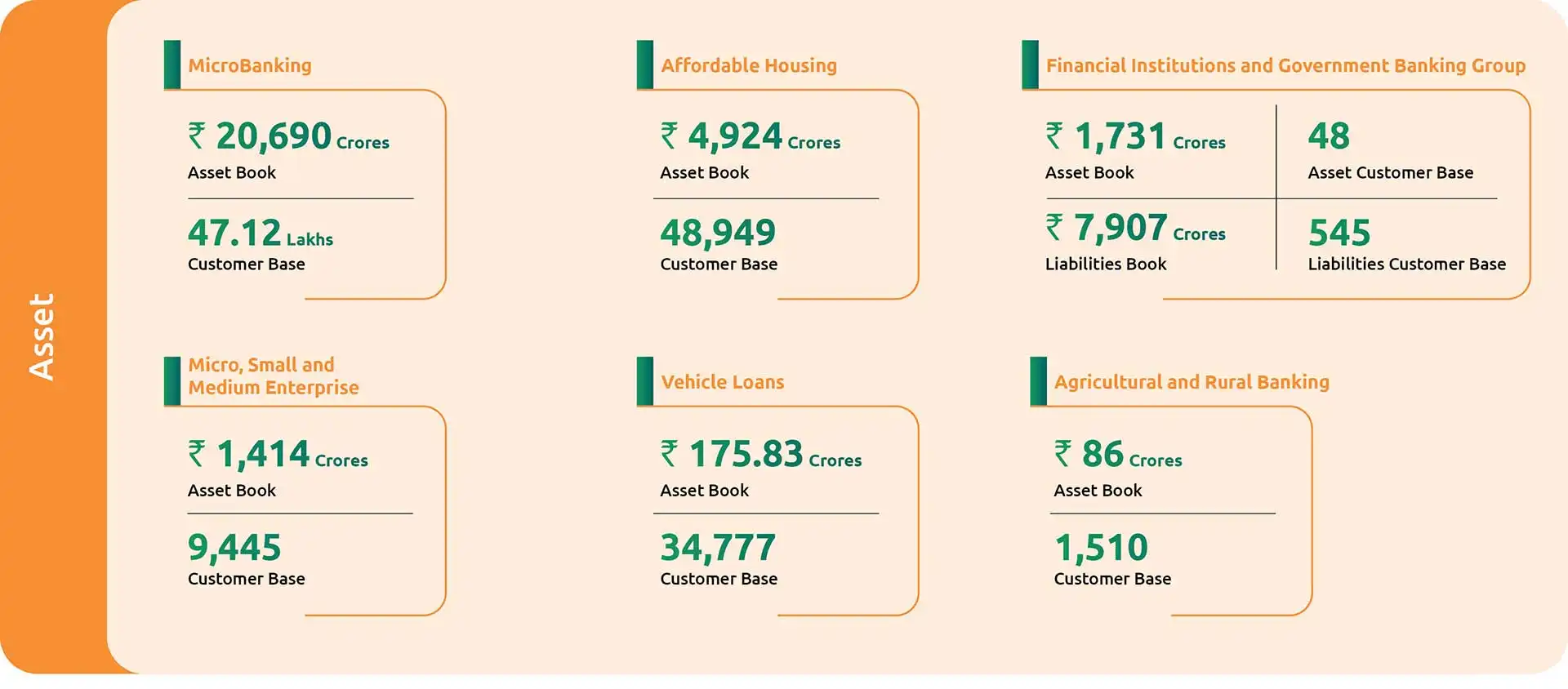

Empowering Communities with Seamless Banking

Extending Progress to the Grassroots

Empowering India’s Growth through MSME

Facilitating Affordable Home Ownership

Empowering Mobility through Finance

Enabling Banking Services for all

Growing Portfolio to Scale Competencies

Enhancing Footprints across BFSI, Corporate and Government Banking Segments

Banking with Empathy and Experience

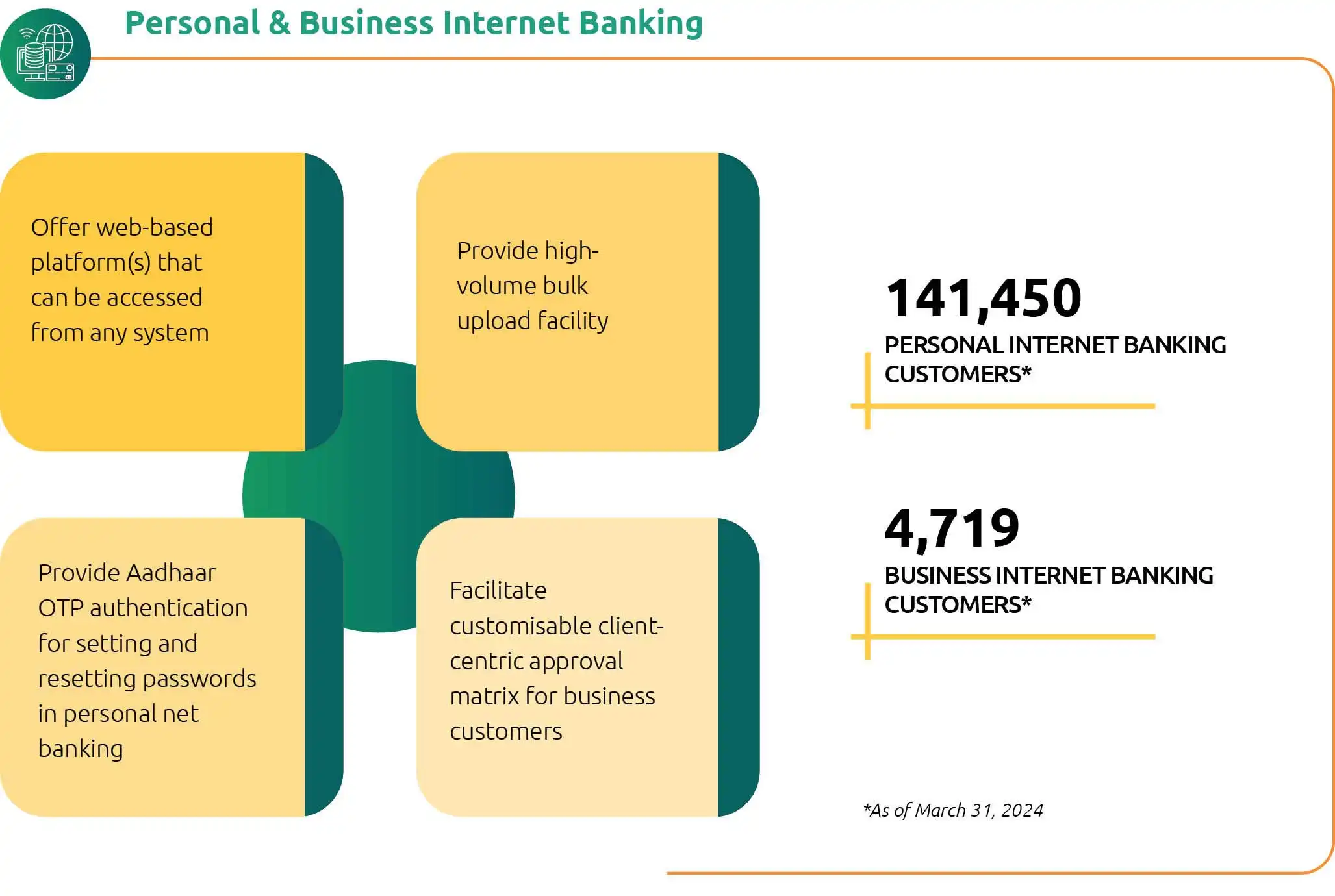

Building and Growing Our Offerings

Evaluating ESG Performance Metrics

Our Sustainability Strategy is like a compass, guiding us towards a more inclusive, resilient, and sustainable future for all stakeholders. Ujjivan SFB's ESG dashboard serves as a window into our achievements for the year, while also setting bold targets and milestones to gauge our ongoing progress.

100%

Offices Equipped with Energy Efficient Lighting

1.2 MT

of electronic equipment Refurbished and Sent for Education Purposes for School Children

9.58 GJ*

of electricity generated through renewable resources (Solar power PV plant)

100%

Digitalisation of the contract management process

2.3

emission intensity (Tonnes co2 equivalent per crore turnover)

20%

Women Representation on Workforce

7.2%

Attrition Reduction during FY 2023-24

35.27

Training Hours Spent per Employee

Top25

‘India's Best WorkplacesTM’ in BFSI Industry 2023

20

Differently Abled Employees as on March 31, 2024

20%

New Women Hires, with 14% recruited under the ‘Unpause’ scheme

₹6.34 Crores

CSR Expenditure

60

CSR projects executed under various thematic areas

2.4 Lakhs+

Training Hours Spent per Employee

200 + Beneficiaries

from Orientation programmes focussed on skill development for employment

23%+

Projects Executed in BIMARU & Aspirational Districts

25,684+

Hours of Employee Volunteering

2,86,200 Hours

of financial literacy training to customers with 90% Women beneficiaries

40+ Years

Average Experience of the Board Members

75%

Non-Executive Directors

75%

Independent Directors

ISO 27001 :2022 + Beneficiaries

Certification obtained on Information Security Management system

ESG Disclosures-

Maiden BRSR, Sustainability & TCFD reports

50%

Gender diversity in Board independent directors

100%

Offices Equipped with Energy Efficient Lighting

1.2 MT

of electronic equipment Refurbished and Sent for Education Purposes for School Children

9.58 GJ*

of electricity generated through renewable resources (Solar power PV plant)

100%

Digitalisation of the contract management process

2.3

emission intensity (Tonnes co2 equivalent per crore turnover)

20%

Women Representation on Workforce

7.2%

Attrition Reduction during FY 2023-24

35.27

Training Hours Spent per Employee

Top25

‘India's Best WorkplacesTM’ in BFSI Industry 2023

20

Differently Abled Employees as on March 31, 2024

20%

New Women Hires, with 14% recruited under the ‘Unpause’ scheme

₹6.34 Crores

CSR Expenditure

60

CSR projects executed under various thematic areas

2.4 Lakhs+

Training Hours Spent per Employee

200 + Beneficiaries

from Orientation programmes focussed on skill development for employment

23%+

Projects Executed in BIMARU & Aspirational Districts

25,684+

Hours of Employee Volunteering

2,86,200 Hours

of financial literacy training to customers with 90% Women beneficiaries

40+ Years

Average Experience of the Board Members

75%

Non-Executive Directors

75%

Independent Directors

ISO 27001 :2022 + Beneficiaries

Certification obtained on Information Security Management system

ESG Disclosures-

Maiden BRSR, Sustainability & TCFD reports

50%

Gender diversity in Board independent directors