Charting ESG Commitments Forward

We are committed to balancing financial success with social responsibility and environmental stewardship. Our sustainability strategy guides our actions aligning operational practices with current ESG trends, regulatory standards, and stakeholder expectations. By integrating sustainable banking practices, we strengthen the resilience of the financial system, address environmental and social challenges, and contribute to the development of a sustainable and inclusive economy.

Evaluating ESG Performance Metrics

Our Sustainability Strategy is like a compass, guiding us towards a more inclusive, resilient, and sustainable future for all stakeholders. Ujjivan SFB's ESG dashboard serves as a window into our achievements for the year, while also setting bold targets and milestones to gauge our ongoing progress.

100%

Offices Equipped with Energy Efficient Lighting

1.2 MT

of electronic equipment Refurbished and Sent for Education Purposes for School Children

9.58 GJ*

of electricity generated through renewable resources (Solar power PV plant)

100%

Digitalisation of the contract management process

2.3

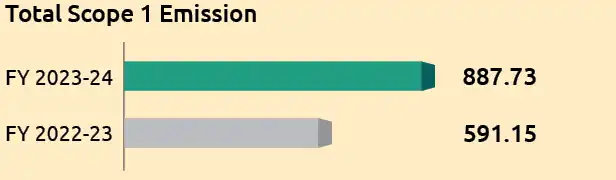

emission intensity (Tonnes co2 equivalent per crore turnover)

20%

Women Representation on Workforce

7.2%

Attrition Reduction during FY 2023-24

35.27

Training Hours Spent per Employee

Top 25

‘India's Best WorkplacesTM’ in BFSI Industry 2023

20

Differently Abled Employees as on March 31, 2024

20%

New Women Hires, with 14% recruited under the ‘Unpause’ scheme

₹6.34 Crores

CSR Expenditure

60

CSR projects executed under various thematic areas

2.4 Lakhs+

Total Lives Impacted

200 + Beneficiaries

from Orientation programmes focussed on skill development for employment

23%+

Projects Executed in BIMARU & Aspirational Districts

25,684+

Hours of Employee Volunteering

2,86,200 Hours

of financial literacy training to customers with 90% Women beneficiaries

40+ Years

Average Experience of the Board Members

75%

Non-Executive Directors

75%

Independent Directors

ISO 27001 : 2022

Certification obtained on Information Security Management system

ESG DISCLOSURES-

Maiden BRSR, Sustainability & TCFD reports

50%

Gender diversity in Board independent directors

Shaping Sustainable ESG Strategies

Ujjivan SFB is committed to balancing financial success with social responsibility and environmental stewardship. Our sustainability strategy outlines our approach, aligning operational practices with current Environmental, Social, and Governance (ESG) trends, regulatory standards, and stakeholder expectations.

Integrating sustainable banking practices is key to strengthening the resilience of the financial system, addressing environmental and social challenges, and advancing towards a sustainable and inclusive economy.

Dividing the sustainability pillar into focussed areas is a strategic approach that allows the Bank to effectively address specific goals and targets within our sustainability initiatives. This approach provides clarity and structure, enabling the Bank to allocate resources, track progress, and achieve meaningful outcomes. The six pillars of the ESG framework are as follows:

This methodical approach enables purposeful initiatives, open reporting, and ongoing enhancements, fostering favourable results for both the business and the wider community.

With the publication of the BRSR as regulatory compliance with the SEBI mandate, the Bank’s inaugural ESG & TCFD reports were published in January 2024, as a voluntary acknowledgement.

ESG Focus Areas and Goals

Each pillar is subdivided into focus areas aimed at achieving specific goals and targets as part of the Bank's sustainability initiatives. These focus areas include:

| Pillar | Focus Area | Goals for 2030 |

|---|---|---|

Sustainable Process |

Sustainable by Operations Sustainable by Design |

20% Reduction in Power Consumption 10% of the Total Office Area (Ujjivan SFB Offices) to achieve ‘Green Building’ Certification |

Empowering Communities |

Corporate Social Responsibilities |

Disclose the Social Value through Social Return on Investment Study |

Human Capital |

Talent Management Diversity, Equity, and Inclusion Human Rights Health, Safety and Wellness |

34 Hours per Employee Training Achieve Gender Diversity upto 30% by FY 2028-29 Zero Accidents – Ujjivan SFB Office Locations |

Effective Governance |

Data Privacy & Cybersecurity Governance Ethics & Compliance Risk Management |

Zero Data Security Breaches Robust Governance Structure, Beyond Compliance Zero Fines/Penalties Achieve Transformative Stage in the Risk Maturity Ladder |

Customer Centricity |

Customer Relationship Management |

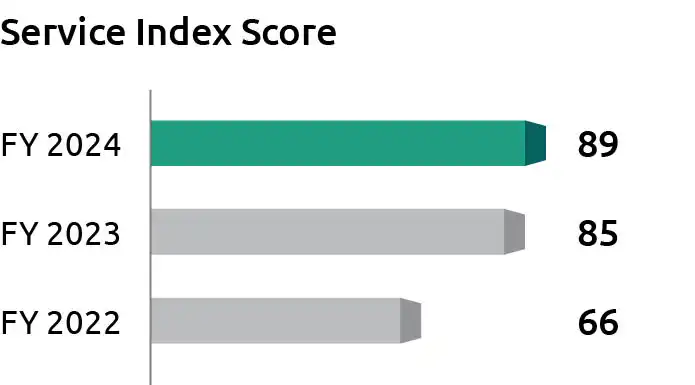

Top Quartile in Customer Satisfaction Survey Score |

Responsible Finance |

Green Finance Inclusive Finance |

Exploring the Green Finance Opportunities Specific to MSME Sector and Electric Vehicle (EV) Financing Expanding Reach & Impact |

Aspects Cutting Across |

Transparency & Disclosures Stakeholder Engagement Digital Transformation |

Aspire to Reach Top Quartile on S&P Global CSA (DJSI) 100% Digital Invoices from Suppliers with Spend of ₹ 10 Million or Higher Bringing 10 Million Customers into Digital Banking Space and Achieving Digital Transactions (volume) of 1,000 Million |

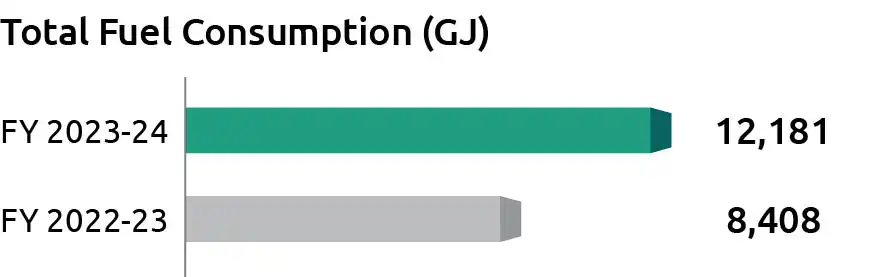

Fostering Environmental Stewardship with Sustainability

At the heart of our operational philosophy and ESG mission lies a deep dedication to nurturing and preserving the environment. Our approach is proactive, rooted in meticulous risk assessments and the establishment of protocols and practices designed to mitigate our environmental impact. As we define goals and targets for the short, medium, and long term across identified material issues, we are aligning our business operations with ESG priorities.

Environment Dashboard

9.58 GJ*

Renewable Energy Consumption (Solar)

1.2 MT

of Electronic Equipment Refurbished and sent for EDUCATIONAL Purposes for School Children

Water Intensity 25.69 KL

Per Crore Turnover

Energy Intensity 11.31 GJ*

Per Crores Turnover

100%

Digitalisation of the contract management process

100%

LED Light Implementation at Corporate and Branch Offices

Prima facie, the Bank has redefined its Mission statement to include sustainability as a measure of setting the tone at the top.

The Bank has come up with all the mandatory and recommended policies to enhance transparency & efficiency, underpinned by a strong governance framework involving the Board of Directors and Management Committees. To infuse ESG considerations throughout its operations, the Bank has implemented a range of crucial policies, code of conduct, and guidelines that actively cultivate and uphold its commitment to responsible banking across the entire organisation.

ESG Governance Structure

The implementation of a multi-tier sustainability governance structure within the Bank is a bold and targeted approach to effectively integrate and monitor Environmental, Social, and Governance (ESG) principles. This structure demonstrates a comprehensive commitment to sustainability by covering various aspects of responsible business practices. Our ESG Governance Structure includes the Board of Directors, Risk Management Committee of the Board, Enterprise Risk Management Committee, and our Implementation Team (Working group).

The Risk Management Committee of the Board ensures that all the current and future material risk exposures of the Bank, including ESG risks, are assessed, identified, quantified, appropriately mitigated and managed. It is also responsible for approving and overseeing the implementation of the Bank-level policy on the ESG parameters.

The Enterprise Risk Management Committee advises the Board on the Bank's policies, strategies, and programmes, focussing on strategy development, goal setting, resource allocation, performance review, and sustainability goal improvement.

The Implementation Team identifies ESG opportunities, implement improvements and the ESG programmes across the Bank.

Board of Directors

Mr. Banavar Anantharamaiah Prabhakar

Part-Time Chairman & Independent Director

Mr. Ittira Davis

Managing Director & Chief Executive Officer*

Mr. Samit Kumar Ghosh

Non-Executive, Non-Independent Director

Ms. Sudha Suresh

Independent Director

Mr. Rajesh Kumar Jogi

Independent Director

Ms. Rajni Mishra

Independent Director

Mr. Ravichandran Venkataraman

Independent Director

Ms. Anita Ramachandran

Independent Director

Risk Management Committee of the Board

Ms. Rajni Anil Mishra

Independent Director

Mr. Banavar Anantharamaiah Prabhakar

Part-Time Chairman & Independent Director

Mr. Rajesh Kumar Jogi

Independent Director

Ms. Sudha Suresh

Non-Independent Director

Mr. Ittira Davis

Managing Director & CEO

Mr. Samit Kumar Ghosh

Non-Independent Director

Enterprise Risk Management Committee

Mr. Ittira Davis

Managing Director & CEO

Mr. Arunava Banerjee

Chief Risk Officer

Mr. Martin Pampilly S.

Chief Operating Officer

Mr. John Christy

Chief Vigilance Officer

Mr. Sathyananda Prabhu

Head of Internal Audit

Mr. Brajesh Joseph Cherian

Chief Compliance Officer

Mr. Ashish Goel

Chief Credit Officer

Ms. Carol Kripanayana Furtado

Whole-Time Executive Director**

Mr. Mocherla Durga Ramesh Murthy

Chief Financial Officer

Implementation Team (Working Group)

Ms. Carol Kripanayana Furtado

Business (Products)

Mr. Zubair Ulla

Digital Channels

Mr. Premkumar Govindappa

Head - Vehicle Finance

Ms. Chandralekha Chaudhuri

Human Resources

Mr. Arunava Banerjee

Risk Management

Mr. Srikumar Vadake Varieth

Legal

Mr. Tahir Khan

Procurement

Mr. Sachin Jadhav

Social Services

Mr. Suresha C

Service Quality

Mr. Sanjeev Barnwal

Company Secretary

*(w.e.f. January 14, 2022 to June 30, 2024)

**(effective May 01, 2024)

Sustainable Banking at Ujjivan SFB

At Ujjivan SFB, we are dedicated to fostering financial growth and achieving a sustainable future for all. We aim to promote financial and digital inclusion by extending banking and financial services and support to the un-served and the under-served segments of society i.e., people from low-income backgrounds, women, rural populations, and marginalised communities.

As a mass-market bank, Ujjivan SFB offers a wide range of banking and financial services and a personalised customer experience. We have identified relevant issues in the banking sector and adopted the best benchmarking practices aligned with the UNSD goals. The Bank also follows the applicable guidelines provided by SEBI/RBI. With technology as a key enabler, Ujjivan SFB has expanded its reach, and enhanced the customer experience. With 750+ banking touchpoints across 328 districts, 23 states and 3 Union Territories, our aim is to provide accessible banking and financial services to a broad range of people. The Bank focusses on providing literacy training and capacity-building programmes to our customers. We prioritise social impact and measure success in financial terms and in terms of positive social outcomes.

Our Initiatives

Sustainable Operations

Our ‘Green’ efforts, starting with the simple initiative of discontinuing paper cups and plates towards environmental sustainability, had a cascaded effect on other initiatives. This included the procurement of energy-saving LED lighting in all offices, waste segregation at source coupled with responsible disposal strategies, digital business cards, and green cleaning chemicals. Moreover, it also included solar energy as the RE (renewable energy) alternative wherever feasible, as well as inverter air conditioners and energy efficient construction materials. With this holistic approach across 750+ branches, our efforts towards promoting eco-friendly practices in the Bank create a profound positive impact on the environment.

Digitisation

Our concerted efforts to reduce paper consumption, and thereby, lower carbon emissions have driven us to digitise numerous operations and products. This includes prioritising customer-centric services that allow transactions from the convenience of home, reducing fuel consumption and enhancing satisfaction. The Bank has witnessed a significant increase in digital transactions, with 37.41 Crores facilitated digitally, constituting 88.54% of all transactions. This was notably boosted by the launch of Digital Savings Account and Digital Fixed Deposits. Additionally, approximately 11.8 Million loan repayments were conducted through digital channels, resulting in substantial reductions in documentation and commuting, leading to significant financial savings. Moreover, 100% of contract management was executed digitally during FY 2023-24.

Diversity, Equity, and Inclusion

Unpause Initiative, a unique initiative by the Bank, is aimed at providing opportunities for women who have taken a career pause and are ready to return to their professional lives. With the current gender diversity rate of 20% in the Bank, about 349 women successfully embarked on their second career through this initiative. We have been actively encouraging our hiring partners and teams to recruit women to accelerate the initiative further.

Additionally, the integration of access facilities such as ramps and restrooms into the new infrastructure, along with the facilitation of orientation sessions for transgender individuals, serves as a testament to our dedication to inclusivity.

Performance FY 2023-24

With our recent venture into the ESG realm, the objectives for FY 2023-24 primarily revolved around establishing procedures for mid- and long-term objectives, investigating opportunities to implement green initiatives across departments, crafting a baseline and developing data management frameworks and assessment procedures. These targets were diligently tracked and assessed on a monthly basis, all of which have been satisfactorily achieved. This exemplifies our commitment to sustainability through deliberate planning and execution.

Recognised for Our Excellence

'Strong' Rating

From CRISIL on our ESG Performance

Leading ESG Champions of India

From Dun & Bradstreet

TESTIMONIALS THAT BRINGS JOY AT UJJIVAN SFB

I am Natarajan S S, and I have been a happy FD account holder at Ujjivan SFB, Ramanathapuram branch, for the past four years. Their service and unique product offerings are commendable. The interest rates on Savings Accounts and Fixed Deposits are highly competitive and attractive. The Bank boasts a strong rating, impressive profits, and low NPA values, reflecting its excellence in every aspect. I am thoroughly satisfied with their service and overall performance.

"I am Gurunathan, a practicing auditor, and my son K.G. Kannan, who is also an auditor and an NRI. Our family has made substantial fixed deposits and holds savings accounts with Ujjivan SFB. The Bank's mobile app and overall services are highly commendable. In particular, the exceptional services provided by Mr. Prakash, the branch manager of the Erode branch, and his team stand out. We have recommended Ujjivan SFB to many of our clients, who have also opened accounts with them."

"I am Retd. Col. Samit Kumar Saha. As a senior citizen, finding a bank that understands my needs and treats me with respect is essential. At Ujjivan SFB, I found exactly that. From the moment I walked into their branch, I was greeted with warmth and professionalism. The Bank's staff consistently goes above and beyond to ensure my banking experience is smooth, secure, and personalised.

Introduced to Ujjivan SFB by a former banker now working at Ujjivan SFB, I am proud to be associated with a bank that values its customers and excels in service, especially for senior citizens like myself. Ujjivan SFB isn't just a bank; it's a caring community, and I am grateful to be a part of it."

"I am Seema Sharda, Director (Retd.) – Forensic Science Lab, Mohali. My husband and I have savings accounts with Ujjivan SFB. The staff's services are excellent, and the Bank provides outstanding products and services tailored for senior citizens."

"The loan from Ujjivan SFB significantly reduced my EMI burden, allowing me to consolidate my debts. Previously, I was struggling with high EMIs, but after getting the loan, my EMI payments decreased substantially. This not only boosted my profitability but also provided extra funds to acquire new customers, leading to increased sales turnover and net profit. Additionally, my reliance on loans from family and friends has diminished."

"The loan from Ujjivan SFB has helped me increase my sales turnover by more than 25%, thanks to the availability of low-cost funds. This has also allowed me to expand my business and set up a CNG station. All necessary NOCs have been cleared from the relevant government department, land has been acquired, and the station will likely be functional in the next 5-6 months."

"I have been a customer of Ujjivan SFB for the past 7 years. I first learned about the Bank from a friend and received a group loan of ₹ 30,000, which helped me grow my small home-based parlour. As my customer base increased, Ujjivan SFB's support boosted my confidence. Due to my good track record, I later secured a larger loan of ₹ 2 Lakhs, allowing me to purchase equipment like hair wash stations, trolleys, beauty beds, and hair appliances. Ujjivan SFB has played a crucial role in my business growth, providing financial stability for my family."

"Namaste! I took my first group loan of ₹ 30,000 from Ujjivan SFB for my home-based tailoring business and always paid my EMIs on time. Recently, I secured a ₹ 2 Lakhs loan for home renovation, adding a study room for my kids. The Bank has consistently supported me financially. In 2022, I proudly served on the Chote Kadam committee for school renovation at CA Road, Nagpur, as part of the Ujjivan SFB team."

"As a farmer cultivating 25 acres with crops such as Bajra, Groundnut, Moong, Green Gram, Wheat, and Gram, I needed additional funds for farm development and crop cultivation. While I had an existing KCC Loan with HDFC, they were unable to extend additional credit when I needed it. Fortunately, a friend employed at Ujjivan introduced me to their KPC Crop Loan.

After thoroughly understanding the benefits and terms of the KPC Crop Loan, I decided to proceed with the application. I received the loan amount within the required timeframe, which significantly aided my farming activities. I am deeply grateful to the Ujjivan team for their support and efficient service."

"The Bank is continuously growing and improving its processes. A few years ago, when my brother took a two-wheeler loan, the process took a considerable amount of time. However, when I recently financed my two-wheeler through Ujjivan SFB, it was smooth and easy."

Mrs. Yashodha from Mysore has paved the way for a prosperous and fulfilling life for herself and her family through multiple gold loans. She availed her first gold loan for home renovation and took the second from a pawn shop. However, due to high interest rates, she transferred it to Ujjivan SFB. The trust in Ujjivan SFB assured her to take a third gold loan for her children's education, ensuring a secure future for them.

I had applied for housing loan in USFB and within short period of time from the date of request, my housing loan was sanctioned and disbursed. I am very happy for the quick response. Before approaching Ujjivan SFB, I had inquired housing loan in 3-4 other financial institution which I did not get in time responses from them, but as soon as I applied in Ujjivan SFB the loan was disbursed in required time. In Ujjivan SFB the loan process was smooth and favourable for common people like us.

During loan process, staff support from “Double road branch” was excellent and they had enough knowledge about the loan process and also explained the terms and condition which I understood.

I am very happy to receive the loan on time.

IMPLEMENTING

EFFECTIVE

GOVERNANCE

PRACTICES

UJJIVAN SFB ENSURES COMPLIANCE AND ADHERENCE TO CORPORATE GOVERNANCE IN LETTER AND SPIRIT. THE BANK RECOGNISES AND ENSURES A CLEAR DISTINCTION BETWEEN THE 1ST, 2ND AND 3RD LINE OF DEFENCES, WHEREIN DEPARTMENTS UNDER 2ND LINE OF DEFENCE I.E. RISK, COMPLIANCE, VIGILANCE ARE INDEPENDENT WITHOUT ANY BUSINESS TARGETS AND REPORT TO THE BOARD COMMITTEE. INTERNAL AUDIT DEPARTMENT, BEING THE 3RD LINE OF DEFENCE, PROVIDES INDEPENDENT ASSURANCE TO THE MANAGEMENT & BOARD ON THE BANK’S RISK MANAGEMENT, GOVERNANCE AND INTERNAL CONTROL PROCESSES AND REPORTS TO THE AUDIT COMMITTEE OF THE BOARD.

The Bank has implemented all necessary and mandatory policies to ensure transparent and efficient operations. Additionally, we have established and maintained a robust governance structure, including the Board and various management committees, to ensure transparent and prompt compliance with Corporate Governance standards.

The Bank believes that the Board and the Board Committees are the pillars of our Corporate Governance. They ensure that the Majority of the Directors are Independent Directors with rich and vivid experiences in Banking, Finance, IT, Risk, Law and Financial Inclusion, among others. The Bank has all the mandatory Board Committees as prescribed under the Companies Act 2013, SEBI LODR 2015, and RBI, like the Audit Committee, Risk Management Committee, Nomination and Remuneration Committee, Shareholders' Relationship Committee, Customer Service Committee, Fraud Committee (Special Committee of Board for Monitoring High Value Frauds), Corporate and Social Responsibility Committee, and Committee of Directors, among others.

The Bank has developed and implemented a Code of Conduct that is applicable to all employees, including the Bank's Directors. It also has an Insider Trading Policy for the Prohibition of Insider Trading. The Bank recognises its role as a corporate citizen and endeavours to adopt the best practices while maintaining the highest standards of corporate governance through transparency in its business, ethics, and accountability to its shareholders, customers, government, and all other stakeholders.

IMPLEMENTING

PROGRESSIVE AND

PROACTIVE

MEASURES

THE BANK HAS A STRONG RISK MANAGEMENT FRAMEWORK IN PLACE TO IDENTIFY, MEASURE, MITIGATE AND MONITOR MATERIAL RISKS ACROSS ALL OUR FUNCTIONS. DIRECTED BY THE RISK MANAGEMENT COMMITTEE OF THE BOARD (RMCB), UJJIVAN SFB HAS AN ADEQUATELY STAFFED RISK MANAGEMENT TEAM LED BY OUR CHIEF RISK OFFICER (CRO) TO IMPLEMENT THE DIRECTIONS OF THE RMCB AND THE BOARD. THERE ARE DEDICATED TEAMS ESTABLISHED WITHIN THE BANK TO ASSESS AND MONITOR ENTERPRISE AND STRATEGIC RISKS, CREDIT RISKS, OPERATIONAL RISKS, MARKET AND LIQUIDITY RISKS AND INFORMATION SECURITY RISKS. THE RISK MANAGEMENT TEAM IS PREDOMINANTLY BASED OUT OF THE BANK’S CORPORATE OFFICE, AND ALSO HAS A PRESENCE IN EACH OF THE REGIONAL OFFICES, PRIMARILY TO AID IN CASCADING THE OPERATIONAL RISK FRAMEWORK AT A GRANULAR LEVEL. THE HALLMARK OF UJJIVAN SFB’S RISK MANAGEMENT FUNCTION IS ITS INDEPENDENCE FROM BUSINESS SOURCING UNITS WITH CONVERGENCE ONLY AT THE BOARD LEVEL.

The RMCB fulfils its roles and duties through various management-level risk committees such as the Credit Risk Management Committee (CRMC), Operational Risk Management Committee (ORMC), Asset Liability and Market Risk Committee (ALCO), Information Security Risk Management Committee and Business Continuity Management Committee. There is also an Enterprise Risk Management Committee (ERMC) to provide oversight on strategic and emerging risks within the Bank while continuing to have general oversight on audit and compliance-related matters. These committees are entrusted with the task of identifying, measuring, mitigating and monitoring specific risks and directing enhancements and new policy advocacy, wherever applicable.

The Bank’s Risk Management Framework is based on a clear understanding of our key material risks, disciplined and well-defined risk assessment and measurement procedures and continuous monitoring. The policies and procedures established for this purpose are continuously benchmarked with best practices. We oversee all our material risks through regular monitoring of risk indicators, policy management, and testing of controls for design and effectiveness. The identified breaches and gaps are analysed thoroughly to determine the associated root cause (s) for initiating corrective actions.

Key Developments During the Year

During FY 2023-24, the economy remained remarkably resilient, with growth holding steady as inflation returned within target bands of the RBI. The journey has been eventful, starting with supply chain disruptions in the aftermath of the pandemic, a Russian-initiated war on Ukraine that triggered a global energy and food crisis, a considerable surge in inflation in FY 2023-24 followed by a globally synchronised monetary policy tightening and regulatory interventions to restrict the buildup of consumer credit. Yet, despite many gloomy predictions, the world avoided a recession, the banking system proved largely resilient, and key emerging market economies did not suffer any major setbacks. The domestic economy continues to experience strong momentum. As per the second advance estimates (SAE), the real gross domestic product (GDP) expanded at 7.6%1 in FY 2023-24 on the back of buoyant domestic demand. Real GDP increased by 8.4% in Q3, with strong investment activity and a lower drag from net external demand. On the supply side, gross value added recorded a growth of 6.9% in FY 2023-24, driven by manufacturing and construction activity.

While most banks and the BFSI sector as a whole stabilised their traditional risks (credit risk, market risk and liquidity risk) in the post-pandemic era, FY 2023-24 (with updates up to May 31, 2024) was evidenced by strong advocacy from the Regulator to focus on the other emerging risks inherent in the industry, specifically the Non-Financial Risks (NFRs). This was evident through the various Master Directions issued by the Regulator where the role of risk management and oversight was mandated or warranted. Given below is a snapshot of the same:

| RBI Guidelines | Guidelines in Brief |

|---|---|

|

Master Direction on Outsourcing of Information Technology Services dated April 10, 2023 |

Banks were directed to put in place a Risk Management framework for Outsourcing IT Services that shall comprehensively deal with the processes and responsibilities for identification, measurement, mitigation, management, and reporting of risks associated with Outsourcing of IT Services arrangements. |

|

Master Direction on Minimum Capital Requirements for Operational Risk dated June 26, 2023 |

While not directly applicable in the SFB context, the new guidelines introduced ‘Basel III Standardised Approach’, which replaces all older methods to capital charge. The Bank, as part of good governance, has commenced its operational risk capital charge under ICAAP as per the new instructions. |

|

Master Direction on Information Technology Governance, Risk, Controls and Assurance Practices dated November 7, 2023 |

Comprehensive guidelines providing specific directions on governance framework, role of the Board of Directors, IT-Related Committees, R&R of Head of IT, IT Infrastructure and Services Management, IT and IS Risk Management, BCP and Disaster Recovery Management and Information Systems Audit. |

|

Framework for Acceptance of Green Deposits dated April 11, 2023 |

Citing climate change and climate risk as one of the most critical challenges, directions were provided by the Regulator for the financial sector which can play a pivotal role in mobilisation of resources for green activities/projects. |

|

Guidelines on Default Loss Guarantee (DLG) in Digital Lending dated June 8, 2023 |

Acknowledging the inherent risks in digital lending models, arrangements between Regulated Entities (REs) and Lending Service Providers (LSPs) or between two REs involving default loss guarantee (DLG), commonly known as FLDG, were examined by RBI, and such arrangements were permitted subject to compliance with the rules specified in the guidelines |

|

|

|

Regulatory Measures towards Consumer Credit and Bank Credit to NBFCs dated November 16, 2023 |

Flagging the high growth in certain components of consumer credit (especially unsecured credit) leading to potential systemic risks, RBI issued specific measures to strengthen BFSI’s internal surveillance mechanisms, address the build-up of risks, if any, and institute suitable safeguards in their own interest. To that effect, risk weights were increased in certain categories of consumer credit and bank credit for specific types of NBFCs. |

|

Voluntary Transition of Small Finance Banks (SFBs) to Universal Banks dated April 26, 2024 |

The eligibility criteria for an SFB to transition to a Universal Bank were disseminated by the Regulator for greater clarity. |

|

Guidance Note on Operational Risk Management and Operational Resilience dated April 29, 2024 |

The guidance note intends to:

|

Discussion the minimum

raft Disclosure Framework on Climate-related Financial Risks, 2024 dated February 28, 2024

Given the increasing threat of climate change and the associated physical damage, changes in market perception and the transition towards more environment-friendly products and services, the impact of climate change on REs was identified as inevitable. It was opined by RBI that REs also play an essential role in financing the transition towards an environmentally sustainable economy. It is, therefore, imperative for the REs to implement robust climate-related financial risk management policies and processes to effectively counter the impact of climate-related financial risks.

An inference on the nature of regulatory directions and guidelines issued as above indicates that the Regulator is increasingly emphasising minimum standards to be maintained by the Bank. When the RBI issued draft guidelines on the themes above, the Bank proactively acted or deliberated upon the requirements during the financial year. Some of the measures initiated are provided in the subsequent section.

Risk Management Framework and Implementation: Key Enhancements during the Year

Area:

Early Warning Systems (EWS)

Treatment Measures:

At a macro level, the Bank monitors industry trends, newsfeeds, and policy changes, which may have a bearing on the portfolio quality. To that effect, the Bank has subscribed to various information databases from external vendors. Using this information, detailed analysis/risks are identified, which collectively form a part of Level 1 EWS framework, covering macroeconomic risk analysis, and are reported internally at regular intervals.

Detailed Key Risk Indicators (Level 2 triggers) are defined to assess the performance on various parameters such as Incremental Overdue, PAR30+, PAR90+, Early Delinquencies, Quick Mortality, Non-Starters, and Collection Performance, among others. These metrics are analysed at various levels and dimensions, such as branch, state, and product, among others. These help identify underperforming segments and pockets for corrective actions early on. The portfolio level triggers were standardised during the year for base-level internal reporting using advanced visualisation tools, and these reports are increasingly automated for ease of reference.

In the previous year, as part of Level 3 EWS triggers at a borrower level, the Bank leveraged its internal capabilities in automating early warning signals based on unique behavioural patterns exhibited by the borrower. These triggers/ exception lists were developed in compliance with the RBI Guidelines on EWS. The automated exception reports enable real-time monitoring of problematic accounts and take necessary course corrections early on. The Bank intends to enhance its monitoring mechanism of these triggers through a system-based solution. This mechanism enables the Bank in the classification of Accounts Under Watch (AUW)/Red Flagged Accounts (RFA) and aids in the classification of frauds. These triggers were carefully evaluated and back-tested at periodic intervals to explain the default propensity. During the year, the Bank worked towards implementing an application to capture the feedback from field officers on such borrowers. The feedback was also evaluated to identify commonalities and key risk drivers. Using these insights, the Bank intends to strengthen its negative profiling framework to restrict exposure build-up in high-risk cases.

For its Institutional Lending portfolio, the Bank has an EWS framework in place which factors data from financial statements, trends in compliance with loan covenants, external rating reports and newsfeed, among others. During the year, the Bank enhanced its approach through the bifurcation of the EWS and AUW frameworks. The EWS assessment for its Institutional Lending portfolio is also expected to be undertaken through a software platform.

Area:

Credit Rating Scorecards/Credit Rating Systems

Treatment Measures:

The Bank’s rating model/scorecard landscape have evolved through the years since its inception. Concerted efforts were made in analysing the Bank’s historical data to identify patterns and trends that can be used in business decision-making. To this effect, the Bank has developed application scorecards and behavioural models that can be used in decision-making and the computation of default probability. The priority with which scorecards and behavioural models were deployed was on the basis of the relative vintage and materiality of the credit segment.

On the Bank’s MFI/Group Loan portfolio, a new statistical scorecard (regression-based) was developed using the post-pandemic data during the year. This scorecard was subject to Out of Sample (OOS) and Out of Time (OOT) validation and was found to be statistically significant. This scorecard will be embedded in the Bank’s Loan Origination System for further testing and stability. The Bank intends to explore the usage of these scorecard outputs in pricing and in fixing delegation at the senior level for high-risk cases initially. The transition will, however, be undertaken only after multiple rounds of out-of-time validation.

Along similar lines, a rating model for an Individual Loans portfolio has been designed using internal data encompassing attributes like demographics, repayment trends and bureau-related variables. Variables were selected on the basis of statistical significance, which best explains the propensity to default. This scorecard was also subject to annual validation and was found to be satisfactory. The scorecard is embedded in the Bank’s LOS platform and continues to be used in credit decision-making and pricing. During the year, the Bank commenced the development of challenger scorecards for the IL portfolio in a bid to improve accuracy.

For Vehicle finance, statistical scorecards using the Bank’s data were developed during the year, separately for New-to-Credit and New-to-Bank/Existing-to-Bank customers. However, since these scorecards were developed using limited internal information, the Bank additionally procured bureau scorecards in a bid to strengthen the credit appraisal process. Decisions on credit underwriting and pricing are taken on the basis of a composite score generated by these scorecards. The Bureau scorecards will retire gradually, along with internal scorecards, as and when data is available.

The pandemic resulted in an acute distortion of data at Bank and Bureau level preventing any meaningful modelling in normal circumstances. Since the MSME and Housing Loan variants are disbursed over a longer time horizon, the inability to capture the performance over longer time horizons in the current portfolio, coupled with the issue of fewer data points, required modelling activity to be postponed up to FY 2026 for these loan segments. In lieu of statistical scorecards, the Bank continues to use credit rating scorecards developed using expert judgement at a product level for MSME, and on the basis of customer segment level in Housing Loans. These scorecards will aid in building a dataset on critical parameters and demographic details which can be used in statistical modelling in the future.

During the year, the Bank also put in place a credit risk model development and validation policy to provide an overall governance framework for model development, monitoring and validation aspects. This policy is a landmark milestone, wherein the learnings from the development and validation of existing scorecards, coupled with best practices in modelling as per BCBS guidelines, are incorporated to standardise all future model-related activities within the Bank.

Area:

Expected Credit Loss

Treatment Measures:

The Bank has in place a detailed framework for computing Expected Credit Loss (ECL) as per the Ind-AS requirements and also for internal reporting purposes. A specialised set of models is in place to compute key risk factors such as forward-looking Probability of Default (PD) estimates, Loss Given Default (LGD) and Exposure at Default (EAD) for our MicroBanking and Housing Loan variants. For all other loan segments, a combination of simple transition matrix/roll forward rates or industry benchmarking is used in the absence of sufficient data.

It is pertinent to take note of the Discussion Paper released by RBI on the ECL framework for provisioning in January 16, 2023. While a mandate to transition from the current IRAC-based provisioning to an ECL-based framework is yet to be notified for commercial banks, the Bank has nevertheless worked towards preparedness to make the transition efficiently. The existing models are observed to be complying to the minimum requirements of the Regulator. Additionally, the Bank has commenced automating our PD and LGD models using internal capabilities. During the year, the automation project was completed for all the credit variants and is currently under testing for accuracy and scalability. It is expected to be moved to production in the ensuing year. The Bank, as part of good governance, continues to report ECL outputs internally.

Area:

Collection Productivity Trackers

Treatment Measures:

A key learning from the pandemic, especially for unsecured lending products, was the need to monitor collection-related KRIs at a granular level. As a monitoring mechanism, the Bank introduced productivity trackers at an officer level against predefined benchmarks. These trackers serve as an important tool in tracking low performance at various levels such as officer, district, state, and loan quantum, among others. In the ensuing year, the Bank intends to leverage our internal capabilities in automating the exception reports/triggers for real-time tracking.

Area:

Credit Risk Monitoring Unit (CRMU)

Treatment Measures:

In a bid to further enhance risk oversight and identify lapses in credit appraisal standards, the Risk team put in place an independent Credit Risk Monitoring Unit (CRMU) in FY 2022-23. The initial focus of CRMU was restricted to reviewing high-ticket loans, identifying and analysing quick mortality cases and the root causes thereof, and providing early insights into vigilance to initiate investigations from a fraudulent angle. Much of the scope was restricted to the review of MSME credit proposals.

During the year, the Bank furthered the Terms of Reference for CRMU to include institutional lending, review of repayment rates, and Early Warning Signals review, among others. Findings of CRMU are analysed for adequacy in policy controls or to identify areas of weaknesses. Post deliberations at CRMU level, policy changes and proposals are made at CRMC for adoption.

Area:

Industry Insights and Portfolio Analysis

Treatment Measures:

Continuous analysis of all loan portfolios to identify potential areas of stress on the basis of geography, ticket size, branch/clusters, among others. Such analysis has helped the Bank set mitigants in the form of limits and caps on exposure. The Bank has also subscribed to various industry dashboards to benchmark portfolio performance.

Area:

Product and Process Reviews

Treatment Measures:

All new products and processes (including enhancements) are subject to a mandatory comprehensive review. We continuously review and enhance our key processes to adapt to industry best practices. During the year under review, the Operational Risk Management Unit reviewed and approved 58 process documents spanning diverse areas.

Area:

User Acceptance Testing

Treatment Measures:

The Bank performs User Acceptance Testing (UAT) to identify gaps in the actual deliverable versus the one proposed in the Business Requirement Document (BRD). These gaps are further addressed and closed during the Functional Specification Documentation (FSD) stage before moving to production. During the year under review, 125 BRDs and FSDs were reviewed and UAT was performed for 70 new developments/changes/fixes provided by the Bank’s IT team.

Area:

Risk and Control Self-Assessment

Treatment Measures:

The Bank has initiated Risk and Control Self-Assessment (RCSA) in all business processes to identify inherent and residual risks. These tools also help identify the design and effectiveness of the controls introduced. The outcome of RCSA activities has helped provide insights into known and potential Operational Risk areas in various processes and business lines.

Area:

Key Risk Indicators (KRIs)

Treatment Measures:

At an entity level, the Bank continues to monitor 40 Key Risk Indicators (KRIs) for strategic impact. While strategic KRIs are intended to be evaluated for operational resilience, there are functional KRIs defined specifically for business units and support functions for tactical management. In FY 2023-24, customised KRIs were introduced in Branch Banking, MicroBanking, Housing Loans and Digital Banking units. These KRIs are analysed on a monthly basis and comprehensive reports are placed to the management and Board at quarterly intervals with an action plan for the closure of open issues.

For the ensuing year, the Bank intends to expand the scope of customised KRIs by expanding the ambit to include secure Agri-banking, vehicle finance, MSME and operations.

Area:

Loss Data Management

Treatment Measures:

Loss Data Management is in place to record material incidents to learn from errors and strengthen existing controls. Incidents are recorded as operational losses and near-miss events. This is followed by a Root Cause Analysis (RCA) of critical incidents. The Bank records instances along the RBI-defined lines of Operational Risk events and process enhancements are tabled at various committees for further action. During the year, the Bank engaged a vendor to put in place a system to capture, report and analyse incidents and losses thereof. This system is expected to be rolled out by Q1 FY 2024-25.

Area:

Outsourcing Risk

Treatment Measures:

During the year under review, the Bank completed a periodic risk assessment of key outsourced vendors. It helped ensure that these vendors comply with the minimum requirements prescribed by RBI and business continuity aspects as per internal norms. The outsourcing policy was also enhanced to adhere to the RBI guidelines on IT outsourcing. Gaps, if any, are regularly analysed as part of the Risk Assessment (RA). Detailed notes are recorded on each vendor through visits, and also, placed at various forums and committees for further action. During the year, the annual assessment for 31 vendors was reviewed and completed.

Area:

Internal Financial Control (IFC) Testing

Treatment Measures:

The Bank along with concerned stakeholders, prepares and enhances Risk and Control Matrices (RCMs). Design, implementation, and operating effectiveness of all the controls mentioned in the RCMs (i.e., financial and operational controls) are tested annually by the Operational Risk team by selecting samples based on risk categories covering different regions and across the review period. The critical gaps observed during such testing are discussed with concerned functions for upgrading controls, which may include automation of the controls.

Area:

Trading/Investment Book Management

Treatment Measures:

The Bank monitors various risk and loss limits such as duration, PV01, stop loss, counterparty exposure, and borrowing and lending limits regularly. Any isolated instance(s) of breach of the limit are immediately brought to the notice of stakeholders, and remedial measures are taken. During the year, the Bank commenced investing in non-SLR securities encompassing Certificate of Deposits, Commercial Papers and Liquid Mutual Funds.

During the year, RBI revised its guidelines on classification, valuation and operation of the Investment portfolio vide circular dated September 12, 2023. As part of these guidelines, policy and system-level changes were warranted in areas such as portfolio classification, revised carrying costs, accounting norms and additional disclosures. The Bank reviewed our preparedness to comply with these new directions w.e.f. April 1, 2024, and necessary changes were implemented in all aspects.

Area:

Behavioural Analysis

Treatment Measures:

During the year, we updated our behavioural analysis of maturity, pre-maturity and rollover trends in Retail and Bulk deposits, revolving credit facilities and SMA collections. Basis the outcome, the impact is factored into the preparation of liquidity statements and broader liquidity management.

Area:

Funding Mismatches under Stressed Scenarios

Treatment Measures:

During the year, the Bank continued to perform comprehensive stress tests on the cash flow statements under various levels of stress scenarios. The outcome of the same was assessed against the liquidity buffers available and linked to the Contingency Funding Plan.

Area:

Liquidity Management

Treatment Measures:

The Bank computes and monitors key ratios such as Liquidity Coverage Ratio, Net Stable Funding Ratio, Structural Liquidity Statement, and Cash/Funding Gap Analysis among others. Thresholds are monitored on a daily/fortnightly basis as applicable and breaches are escalated as per internal policy norms for corrective actions.

Area:

Capital Management and Adequacy

Treatment Measures:

The Bank computes our Risk Weighted Assets as per RBI guidelines. The impact on the Capital to Risk (Weighted) Assets Ratio (CRAR) is computed and assessed along with providing a forward guidance to the capital adequacy through its Internal Capital Adequacy and Assessment Process (ICAAP). While SFBs are mandated to assess capital adequacy only for its credit risks, the Bank, as part of good governance, also assesses our capital buffers after factoring all Pillar I risks viz, credit risk, operational risk and market risk. CRAR, after factoring Pillar I risks, is also disclosed by the Bank in our Pillar III disclosures. As part of ICAAP, economic capital requirements are computed and reviewed against availability for adequacy assessment.

Area:

Pillar II and Strategic Risk Assessments

Treatment Measures:

A key imperative for the ERM unit is to analyse and identify capital requirements for those risks that are not covered/are partially covered under the Pillar I risks. The scope of capital adequacy assessment for Pillar II risks includes liquidity risk, interest rate risk in banking books, concentration risks and underestimation in credit risks, among others. The ERM unit actively engages with the silo-based risk units throughout the year to identify the capital needs for unexpected losses.

As part of strategic risk management, the unit developed and deployed advanced risk management tools during the year, as below:

- Bank Performance Index (BPI): A 360-degree performance assessment tool covering strategy, financial, risk & compliance and internal control parameters at the Bank level. During the year, the Bank replaced our erstwhile Bank Stability Maps, which limited our focus to CAMEL parameters, with the BPI, which evaluates performance on various facets. The outputs of the BPI are directly linked to the Risk Appetite framework for ongoing monitoring.

- Risk Adjusted Return on Capital (RAROC): To identify business units adding shareholder value.

- BCG Growth Share Matrix: To identify business units/regions/branches and their positioning in the BCG growth-share matrix - star, cash cows, question marks and dogs.

- Capital Allocation Framework: Allocation of economic capital to business units and integration to Funds Transfer Pricing (FTP) for profitability assessment/recovery of capital costs.

- Coverage ratio: An alternate measure to identify insolvency upon recognition of the true extent of losses.

Area:

Stress Testing and Scenario Analysis

Treatment Measures:

The Bank undertakes comprehensive stress testing of all loan portfolios using sensitivity and scenario analysis. The impact of adverse events on the PAR%, NPA%, provisions and capital adequacy is assessed at regular intervals. The Bank’s stress testing framework complies with the requirements for ‘Group C’ bank as specified in Stress Testing guidelines dated December 2, 2013. Capital adequacy requirements are evaluated under various levels of stress for inclusion in the ICAAP document.

In scenario analysis, the Bank used advanced statistical techniques to ascertain interrelationships with macroeconomic parameters. To this effect, a Proof of Concept (POC) was developed and deliberated upon for enhancement during the year. These models, after further fine-tuning, are proposed for use in scenario analysis and balance sheet simulations. Since these models are data intensive and industry practices are yet to emerge, the Bank intends to take a transitional approach for linkage to strategic decisions after multiple rounds of backtesting and validation.

On climate risk stress testing, the Bank continued to assess the financial impact of climate-induced physical risks over a short-term period (1 to 3 years). These models were developed by benchmarking scenarios prescribed by the Network for Greening the Financial System (NGFS). Given that climate risk is an emerging area and the best practices are yet to emerge, incremental enhancements to the framework will be undertaken on an on-going basis on a best effort basis.

Area:

Climate Risk Management

Treatment Measures:

The Bank has been proactive in its efforts towards climate risk management. Based on expectations laid out by RBI in its Discussion Paper on climate risks dated July 27, 2022, the Bank had relied on the BCBS prescribed TCFD disclosures framework early on to put in place a governance framework, climate risk strategy, risk management and metrics for monitoring. It is pertinent to note that the Bank was the first SFB to publish its TCFD disclosures report for FY 2022-23 in November 2023. On internal review, it was seen that the Bank’s maiden disclosures were already complying with the aspects laid out in the Draft Disclosure Framework on Climate-related Financial Risks, 2024 dated February 28, 2024. Based on materiality, much of the internal policy advocacy was on risk management with respect to physical risks. To this effect, we mapped our micro banking credit exposure, which is vulnerable to floods and cyclones and appropriate exposure limits were included as part of the credit policy. In the ensuing year, the Bank intends to evaluate the posture of transition risks in retail segments, namely vehicle, housing and MSME segments.

Area:

Model Risks

Treatment Measures:

As stated above, with the introduction of statistical scorecards, there was a need to put in place a policy to govern the development, maintenance and validation aspects of risk modelling. To that effect, a Board-approved policy for credit risk model development and validation policy was put in place. While the initial policy restricts the scope to application scorecards, behavioural scorecards, and ECL models, it is envisioned to be increased progressively to other modelling activities.

A greater need for a formal structure to evaluate model risks arose with the introduction of pricing models. A key exercise initiated during the quarter was a comprehensive review of pricing strategies adopted in all Strategic Business Units. While RBI guidelines on loan pricing mandate the delineation of spread components and the assignment of benchmarks (MCLR or EBLR) to loan pricing, the Bank undertook an internal exercise to evaluate the reasonableness and effectiveness of loan pricing to meet strategic imperatives. The Bank developed pricing models using internal data estimates (e.g., ECL outputs) and external benchmarking, wherever applicable. Further, these pricing models were carefully evaluated for alignment to business strategy, budgets, system feasibility, adherence to prudential risk management norms, and compliance with RBI guidelines on interest rate management. A salient feature in these pricing models includes the adoption of a differential pricing matrix, wherein pricing of loans to borrowers would be risk-adjusted to reflect the borrower’s creditworthiness. The Bank believes that the introduction of RBP will aid in encouraging and incentivising borrower(s) to maintain a long-term relationship. These pricing models are expected to be made effective by June 1, 2024 and will be subject to regular backtesting or validation to identify model risks.

Information Security

With the ever-increasing global threat landscape, the Bank recognises the significance of a robust Information Security structure and has therefore implemented in-depth technologies to safeguard customers’ interest. The Bank has orchestrated tools in such a manner that acts by a malicious intruder are identified quickly without going undetected.

The key elements and the teams working in a chain fashion to manage information security risks are as follows:

-

Risk Assessment

Risk Assessment

and Management -

Policies and

Policies and

Procedures -

Security Awareness

Security Awareness

and Training -

Governance, Risk

Governance, Risk

and Compliance -

Blue Team (Security

Blue Team (Security

Operations Centre) -

Red Team

Red Team

(Ethical Hacking)

The Bank regularly participates in Cyber drills conducted by the Institute of Development and Research on Banking Technology (IDRBT) and conducts periodic Disaster Recovery Drills for our technology infrastructure. This helps us to ensure the availability of critical services in the event of a disaster. Ujjivan SFB follows a proactive approach instead of a reactive approach.

Way Forward

As reiterated before, the increasing focus of the Regulator on risk management, especially in the non-traditional areas (NFRs and climate risk and others) is expected to be a mainstay over the next few years. While it is imperative for the Bank to continue its oversight of traditional risks, capacity building on emerging risks is the need of the hour. This is further backed by robust technology infrastructure so that risk management can keep track of the ever-increasing complexity and changing operating environment. Risk culture and tone at the top continue to be the backbone and critical success factor.

Information security is recognised as an ongoing requirement within the Bank, warranting continuous involvement, improvement and adaptation to the ever-increasing threat landscape. Some of the key achievements during the year were as below:

-

ISO 27001:2022 Certification

The Bank’s Information Security Management System was recently certified as compliant with ISO 27001:2022 Standard. It demonstrates the Bank’s commitment to managing the IS risks effectively, protecting confidentiality, integrity and availability of information assets, and instils confidence in customers and other stakeholders to utilise the digital services of the Bank.

-

Cloud Access Security Brokers (CASB) for Cloud Visibility

Deployed CASB with Reverse Proxy as a ‘last mile’ technology that is placed in cloud services (e.g., Office 365) to provide inline security capabilities to monitor traffic ‘user-to-cloud’, and also, strengthen data leakage prevention controls through organisation-specific use cases to safeguard data.

-

Cloud Security Posture Management (CSPM)

Implemented a CSPM solution with CDR (Cloud Detection and Response) capabilities for Cloud Infra Monitoring to identify misconfigurations, compliance verification against configuration standards like CIS, ISO 27001, PCI-DSS, NIST 800-53, and CSA CCM, among others.

-

Attack Simulation Solution

Implemented attack simulation solution, which is used to simulate attacks to verify the detection and prevention capabilities of the security solutions in place (WAF and Firewall, among others).

-

DNS Security Solution

Implemented Domain Naming Service (DNS) security solution to protect against DNS-based threats, secure web traffic, and protect against data exfiltration.

ENHANCING TRANSPARENCY

AND ACCOUNTABLITY

Mr. Banavar Anantharamaiah Prabhakar

Part-Time Chairman & Independent DirectorMr. Banavar Anantharamaiah Prabhakar is the Part-Time Chairman and Independent Director of the Bank. He possesses about 4 decades of rich experience in serving various banks including Bank of India, Andhra Bank and Bank of Baroda. He retired as Chairman & Managing Director of Andhra Bank in August 2013 and has also served as the Executive Director of the Bank of India. He was on the Board of Karnataka Bank Ltd. as an Independent Director for five years and on the Board of Canara HSBC OBC Life Insurance Co. Ltd., for 6 years from 2015 to 2021. He holds a Bachelor’s degree in commerce from the University of Mysore and is a Chartered Accountant with the Institute of Chartered Accountants of India.

Mr. Ittira Davis

Managing Director & Chief Executive Officer(w.e.f. January 14, 2022 to June 30, 2024)

Mr. Ittira Davis is the Managing Director & Chief Executive Officer of the Bank until June 30, 2024. He is an international banker with over 4 decades of banking experience, having worked extensively in India, the Middle East and Europe. He was with the Europe Arab Bank from July 2008 to October 2012 initially as the Managing Director of Corporate and Institutional Banking and then as an Executive Director. He previously worked with Citibank in India and the Arab Bank Group in the Middle East. He has been associated with Ujjivan since 2015 and played a pivotal role in its transition into a Small Finance Bank. Later, he was the Chief Operating Officer of the Bank until June 2018, after which he took charge as the MD & CEO of Ujjivan Financial Services Limited from July 2018 to March 2021. He was also an Additional Director (Non-Executive, Non- Independent) of the Bank from March 13, 2021 till July 23, 2021. Mr. Ittira Davis is a graduate from the Indian Institute of Management, Ahmedabad (1976).

Mr. Sanjeev Nautiyal

Managing Director & Chief Executive Officer(effective July 01, 2024)

Mr. Sanjeev Nautiyal will be taking charge as the Managing Director & Chief Executive Officer of the Bank effective from July 01, 2024. He is a banker with over three decades of extensive strategic domain expertise in Retail, SME, Financial Inclusion, Operations, HR, International Banking, and Treasury. He earlier held significant roles as Deputy Managing Director, Financial Inclusion & Micro Markets, SBI and MD & CEO, SBI Life Insurance. He was serving as an Independent Director of Life Insurance Corporation and as an advisor in various organisations. Mr. Nautiyal holds a Bachelor’s degree in Arts and a Master’s degree in Business Administration. He is also a Certified Associate of the Indian Institute of Bankers.

Ms. Carol Kripanayana Furtado

Whole-Time Executive Director(effective May 01, 2024)

Ms. Carol Kripanayana Furtado is a Whole-Time Executive Director of the Bank. Earlier, she was designated as the Chief Business Officer of the Bank. Ms. Carol Kripanayana Furtado has 3 decades of banking experience in Retail Banking and NBFC domains with expertise in leading Business, Banking Operations, Credit, People functions and Service Quality. Ms. Carol is a key member of the leadership team that laid the foundation and built Ujjivan SFB. She was instrumental in the recognition of Ujjivan SFB as a certified Great Place to Work. She has previously worked with the ANZ group, Bank Muscat and Centurion Bank Ltd. In 2009, Ms. Carol was the recipient of the Financial Women’s Association award by Women’s World Banking in recognition of her demonstrated professional commitment. She is a post graduate from Mount Carmel Institute of Management, Bangalore, and has been part of strategic leadership programmes conducted by Indian Institute of Management, Ahmedabad and Harvard Business School, Boston.

Mr. Samit Kumar Ghosh

Non-Executive, Non-Independent DirectorMr. Samit Kumar Ghosh is a Non-Executive, Non-Independent Director of the Bank. He was the Non-Executive Director and Chairman of Ujjivan Financial Services Limited (“UFSL”). He founded the UFSL in 2004 and served as its MD & CEO until January 31, 2017. With the approval of the Reserve Bank of India, he was designated and took charge as the MD & CEO of Ujjivan Small Finance Bank Limited effective from February 01, 2017 and retired on November 30, 2019 from this position on attaining the age of 70 years. He is a career banker with over 3 decades of experience in India and overseas with a specialisation in retail banking. He was part of the management team which launched retail banking with Citibank in 1985, Standard Chartered Bank in 1993 and HDFC Bank in 1996 and his last employment prior to founding UFSL was in Bank Muscat. He has completed MBA from Wharton School of Business at the University of Pennsylvania, USA.

Ms. Sudha Suresh

Independent DirectorMs. Sudha Suresh is an Independent Director of the Bank. She is a finance professional with a rich experience of more than two decades in private and public companies and a decade as a practicing chartered accountant. She is the founding partner of S. Rao & Associates, Chartered Accountants, Bangalore. She is also the founder of Mani Capital. She was the Managing Director and CEO (2017-2018) and Chief Financial Officer (2008-2017) of Ujjivan Financial Services Limited. Prior to this, she served as the CFO/Finance Head for many companies. She is serving as an Independent Director on the Board of Royal Sundaram General Insurance Co. Ltd. She is a qualified Chartered Accountant with the Institute of Chartered Accountants of India and a Company Secretary with the Institute of Company Secretaries of India. She is also a Grad ICWA from the Institute of Cost & Work Accountants of India.

Mr. Rajesh Kumar Jogi

Independent DirectorMr. Rajesh Kumar Jogi joined the Bank as an Independent Director. He brings rich work experience spanning almost 3 decades in the banking industry, with a focus on risk management. He last worked with the Natwest Group (and the RBS Group), where he led key strategic projects and transformation. He was the Chief Risk Officer, India, of the Royal Bank of Scotland and subsequently the Country Head of Risk, India, for the Group. He is also a Non- Executive Director on the Boards of a few other companies. Mr. Rajesh Kumar Jogi holds a Bachelor of Arts degree in economics and is a Fellow member of the Institute of Chartered Accountants of India. He also attended the Advanced Management Programme at the Harvard Business School in Boston.

Ms. Rajni Mishra

Independent DirectorMs. Rajni Mishra is an Independent Director of the Bank. She has been a career banker for nearly four decades, with State Bank of India as well as its Associate Banks, where she has handled varied assignments and diverse portfolios, gaining exposure in Branch Administration, Corporate Credit, Forex Treasury, Vigilance, Audit & Inspection etc. She is also serving as an Independent Director on the Board of Cupid Limited and Aspinwall and Company Limited. She holds Master’s Degree in Commerce (Gold Medallist) from M S University, Vadodara.

Mr. Ravichandran Venkataraman

Independent DirectorMr. Ravichandran Venkataraman is an Independent Director of the Bank. He has a rich track record spanning more than three decades of having worked in India, London and Bahrain and brings a strong business background and has worked with top Business Leaders in over 100 countries. He is the Chairperson of eVidyaloka Trust. Earlier, in his role as Senior Vice President of HP’s Global Business Services, he was responsible for developing the Company’s shared services strategy and its global operating model. He joined Hewlett Packard from ANZ Bank’s global back office, where he was the Managing Director, responsible for managing a team of over 5,000 in technology and operations. Prior to that, he was Vice-President – Corporate and Investment Banking at Bank Muscat and was part of the leadership group that set up the Bank in India. He has passed FCCA and ACMA from the United Kingdom. He has also completed a programme for CFOs with Wharton Business School, USA.

Ms. Anita Ramachandran

Independent DirectorMs. Anita Ramachandran is an Independent Director of the Bank. She is a well-known HR expert in the country and has over four decades of experience as a management consultant. She began her career in the Management Consultancy division of AF Ferguson & Co (the KPMG network company in India then) in Mumbai in 1976 as the first woman consultant in the firm. She founded Cerebrus Consultants in 1995 to focus on HR advisory services. She is known as an authority in Reward Management in the country and has worked on HR transformation initiatives across sectors. She also works with several PE firms and start-ups to mentor them through their growth journey. She is also an Independent Director on the Board of several reputed listed companies such as Grasim Industries, Metropolis Healthcare, Happiest Minds, Blue Star Limited and FSN E-commerce (Nykaa) and also in few unlisted Companies including Godrej & Boyce Limited and Aditya Birla Housing Finance Limited. She also, supports many organisations in the social sector through pro-bono professional work and remains deeply committed to working with women. She has completed her MBA from the Jamnalal Bajaj Institute, Mumbai.

Ms. Mona Kachhwaha

Independent DirectorMona Kachhwaha has over 30 years of experience in banking and impact investing. She is a Partner at UC Impower, an early-growth stage equity fund, incubated by Unitus Capital (2020-Present). UC Impower invests in financial inclusion and climate solutions and has a gender-lens on investments. Previously, at Caspian Impact Investment Adviser (2007-2019), she managed the India Financial Inclusion Fund, a growth equity fund focussed on inclusive finance; she was on the credit and investment committees of subsequent funds launched by Caspian. As the nominee on the board of early as well as growth stage companies, and subsequently as an independent director on some boards, she has played an active role in their governance and shaping their strategies. She started her career at Citibank (1994- 2007), where she worked across various retail asset businesses and led the bank’s foray into Inclusive Finance in 2005. Ms. Mona graduated in Mathematics (Hons.) from Delhi University (1992) and holds an MBA from XLRI, Jamshedpur (1994). She completed an executive programme in Private Equity from Said Business School, Oxford University, in 2010.

PROFILING KEY

LEADERSHIP EXCELLENCE

Mr. Ittira Davis

Managing Director & Chief Executive Officer(w.e.f. January 14, 2022 to June 30, 2024)

Qualification: He is a graduate from the Indian Institute of Management, Ahmedabad (1976).

Mr. Ittira Davis is the Managing Director & Chief Executive Officer of the Bank. He is an international banker with over 40 years of banking experience, having worked extensively in India, Middle East and Europe. He was with the Europe Arab Bank from July 2008 to October 2012 initially as the Managing Director – Corporate and Institutional Banking and then as an Executive Director. He also previously worked with Citibank in India and the Arab Bank Group in the Middle East. He has been associated with Ujjivan since 2015 and played a pivotal role in its transition into a Small Finance Bank. Later, he was the Chief Operating Officer of the Bank until June 2018, after which he took charge as the MD & CEO of Ujjivan Financial Services Limited from July 2018 to March 2021. He was also an Additional Director (Non-Executive, Non-Independent) of the Bank from March 13, 2021 till July 23, 2021.

Mr. Sanjeev Nautiyal

Managing Director & Chief Executive Officer(effective July 01, 2024)

Qualification: Mr. Nautiyal holds a Bachelor’s degree in Arts and a Master’s degree in Business Administration.

Mr. Sanjeev Nautiyal will be taking charge as the Managing Director & Chief Executive Officer of the Bank effective from July 01, 2024. He is a banker with over three decades of extensive strategic domain expertise in Retail, SME, Financial Inclusion, Operations, HR, International Banking, and Treasury. He earlier held significant roles as Deputy Managing Director, Financial Inclusion & Micro Markets, SBI and MD & CEO, SBI Life Insurance. He was serving as an Independent Director of Life Insurance Corporation and as an advisor in various organisations. Mr. Nautiyal holds a Bachelor’s degree in Arts and a Master’s degree in Business Administration. He is also a Certified Associate of the Indian Institute of Bankers.

Ms. Carol Kripanayana Furtado

Whole-Time Executive Director(effective May 01, 2024)

Qualification: She is a postgraduate from Mount Carmel Institute of Management, Bangalore, and has been part of strategic leadership programmes conducted by Indian Institute of Management, Ahmedabad and Harvard Business School, Boston.

Ms. Carol Furtado is the Whole-Time Executive Director of the Bank w.e.f May 1, 2024. She comes with 29 years of banking experience in Retail Banking and NBFC domains with expertise in leading Business, Banking operations, Credit, People functions and Service Quality. Ms. Carol is a key member of the leadership team that laid the foundation and built Ujjivan SFB. She was instrumental in the recognition of Ujjivan SFBas a certified Great Place to Work. She has previously worked with the ANZ group, Bank Muscat and Centurion Bank Ltd. In 2009, Ms. Carol was the recipient of the Financial Women’s Association award by Women’s World Banking in recognition of her demonstrated professional commitment.

Mr. Martin Pampilly S

Chief Operating OfficerQualification: He has a graduate degree in Computer Science and a certification of Chief Operations Officer programme from IIM Lucknow. He is also certified in the Strategic Leadership Development programme from Harvard University.

He comes with over 27 years of experience covering Retail Banking operations, Retail Asset and Micro-finance Operations, with expertise in set-up and implementation of new processes. More importantly, he’s known for leveraging technology for operations innovation to create delightful customer experiences. After early stints with ANZ Grindlays Bank and Bank Muscat, he worked extensively in the areas of Operations, Customer Service at the Centurion Bank of Punjab and Centillion Solutions & Services. He joined Ujjivan Financial Services Limited in 2009 and was the Head of Operations, a post he held till January 2017. Subsequently, appointed as the Head of Operations of Ujjivan SFB in February 2017, where he channelled his vast experience into setting up the back office operations for the Bank. As Chief Operating Officer he oversees Operations, Centralised Process Management, Service Quality, Digital Banking, Data Analytics, Legal, Social Services, Alliances & Electronic banking department.

Mr. Ashish Goel

Chief Credit OfficerQualification: Bachelor of Technology degree in Mechanical Engineering from Regional Engineering College, Kurukshetra and is a post graduate in Marketing & Finance from Xavier Institute of Management, Bhubaneswar.

Mr. Ashish Goel was previously employed at Godrej & Boyce, Marico Industries and ICICI Bank. He joined Ujjivan as Chief Credit Officer in February 2021.

Mr. M.D. Ramesh Murthy

Chief Financial OfficerQualification: Chartered Accountant (Articled with A. F. Ferguson & Co., Hyderabad) and has also completed the General Management Program from Harvard Business School, Boston, USA.

He carries 32 years of experience in Business, Risk Management and Finance. In his long tenure, he has held the positions of Managing Director and Head-Project & Structured Finance Division, Corporate & Investment Banking Group; Senior Vice President & Head – Credit Analysis & Portfolio Management, Senior Vice President & Head - Corporate Restructuring Division; Senior Vice President – Risk Management and Head of Wholesale Risk, amongst others. The previous organisations he worked with include ANZ Grindlays Bank, Mashreqbank, Dubai and Commercial Bank International, Dubai, U.A.E. He was last associated with Karur Vysya Bank as its Chief Financial Officer (From November, 2020 to February, 2022), and also held the position of Chief Risk Officer (Since April, 2018).

Mr. Arunava Banerjee

Chief Risk OfficerQualification: Master’s degree in Arts (Economics) from Calcutta University and is an associate of the Indian Institute of Bankers.

Mr. Arunava Banerjee joined the Bank on February 01, 2017. He started his career with State Bank of India as a Probationary Officer and was selected early in this career for a deputation to the Bank’s office in London. Following State Bank of India, he worked with Standard Chartered Bank with their Merchant Banking Division, both in their New Delhi and Mumbai offices. He then moved back to corporate banking with Bahrain Saudi Bank in Bahrain before moving to Remza Investment Company, a family conglomerate, also based in Bahrain, with varied interests. He has overseen the setting up of the Risk Management Department at Ujjivan, first at the MFI and then with the Bank upon its transformation.

Mr. Brajesh Joseph Cherian

Chief Compliance OfficerQualification: Bachelor’s degree in Pharmacy from Dr MGR Medical University and a Masters degree in Business Administration from Sikkim Manipal University. He is a Certified Associate of the Indian Institute of Bankers and has been part of strategic leadership programme conducted by Wharton Business School ,USA.

Mr. Brajesh Joseph Cherian is a banking and financial services professional with over 24 years of experience in Risk Management, Regulatory Compliance, Corporate Banking, Retail Banking ,SME Credit ,Trade Finance and Treasury. Starting his career with the South Indian Bank. Later, he worked with Axis Bank in India and UAE where he handled various roles including serving as the Deputy CEO for Dubai Operations. Before joining Ujjivan in 2016, his last assignment was as the Vice President - Compliance and Risk with Axis Bank, Mumbai.

Mr. Rajeev Padmanabh Pawa

Head of TreasuryQualification: MBA from the Jamnalal Bajaj Institute of Management Studies, Mumbai and a Physics Major from the University of Mumbai.

Mr. Rajeev Pawar is the Head of Treasury of the Bank. He has more than 30 years of international banking and treasury experience. He has set up and run treasury businesses in Singapore, Dubai and India. The key positions that he has held include Head of Fixed Income – Kotak Mahindra International Ltd, Singapore, Director – Rates and Credit Trading, Standard Chartered Bank, Dubai, Director and Head of Trading – American Express Bank, India. He is also an active writer and commentator on financial markets. Mr. Pawar is Member - Board of Studies for colleges under the University of Mumbai. He holds a MBA from the Jamnalal Bajaj Institute of Management Studies, Mumbai and a Bachelor Degree in Science (Physics) from University of Mumbai.

Mr. Sanjeev Barnwal

Company Secretary & Head of Regulatory FrameworkQualification: A qualified Company Secretary and an Associate Member of the Institute of Company Secretaries of India and holds a bachelor's degree in law and a diploma in Business Management. He also received the NSE’s Certification in Financial Markets (NCFM) for the Compliance Officer (Corporate) Module.

He has a corporate experience spanning over 20 years and his last employment was with Ujjivan Financial Services Limited where he was last designated as the CEO & Company Secretary.

He has played pivotal roles in several key milestones in Ujjivan including private equity raise, IPO & listing, banking licence application and processing, formation of the Bank, restructuring through slump sale, listing of the Bank, Qualified Institutional Placement and recently accomplished Reverse Merger of the Holding Company with the Bank. He has earlier worked with SMC Capitals Limited, CMC Ltd. and SBEC Sugar Ltd.

Mr. Mangesh Mahale

Chief Technology OfficerQualification: Completed his Bachelor of Engineering in Computer Technology from VJTI, Mumbai.

Mangesh is the Chief Technology Officer of the Bank. He joined the Bank with 27 years of experience in Strategic & Operational IT Planning, IT Infra Management, Data Center Management Application Development, Stakeholder Management, Digital Transformations, IT Service Delivery Management & Technology Leadership.