What is IFSC Code and How to Find it?

April 17, 2025

In the world of modern banking, convenience and security are paramount. Imagine being able to transfer money anywhere in the country with just a few taps on your smartphone. This magic is made possible by the Indian Financial System Code, or IFSC. But what exactly is this code, and why is it so essential for electronic transactions? In this blog, we’ll dive deep into the world of IFSC codes, unravel their structure, and explore their role in making India’s banking system more efficient and transparent.

IFSC Code Full Form and Meaning

The full form of IFSC is Indian Financial System Code. This 11-character alphanumeric code is unique to each bank branch in India. IFSC is essential for facilitating online money transfers through systems like National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS), and Immediate Payment Service (IMPS).

The IFSC code acts as a digital address, ensuring that your funds reach the right bank branch efficiently and securely. Without it, electronic banking would be prone to errors and delays.

The Format of an IFSC Code

An IFSC code consists of three components:

- Bank Code: The first four alphabetic characters represent the bank (e.g., “UJVN” for Ujjivan Small Finance Bank).

- Separator: The fifth character is always a zero (‘0’), reserved for future use.

- Branch Code: The last six characters uniquely identify the bank branch.

Example: For the HSR Layout (Bangalore) branch, the IFSC Code is: UJVN0001111

- UJVN = Bank name

- 0 = Reserved separator

- 001111 = Branch code

The Importance of IFSC Codes in Banking

IFSC codes play a crucial role in the banking system. Here’s why they matter:

- Accurate Fund Transfers: IFSC codes ensure that funds are sent to the correct bank branch, reducing errors and delays.

- Paperless Transactions: It facilitates electronic transfers like NEFT, RTGS, and IMPS, eliminating the need for physical cheques or cash.

- E-commerce and Bill Payments: IFSC codes enable hassle-free online payments for shopping, utility bills, EMIs, and more.

- Fraud Prevention: The Reserve Bank of India (RBI) uses IFSC codes to monitor and regulate electronic transactions, ensuring transparency and security.

Where to Find the IFSC Code?

Here are four common ways to locate an IFSC code:

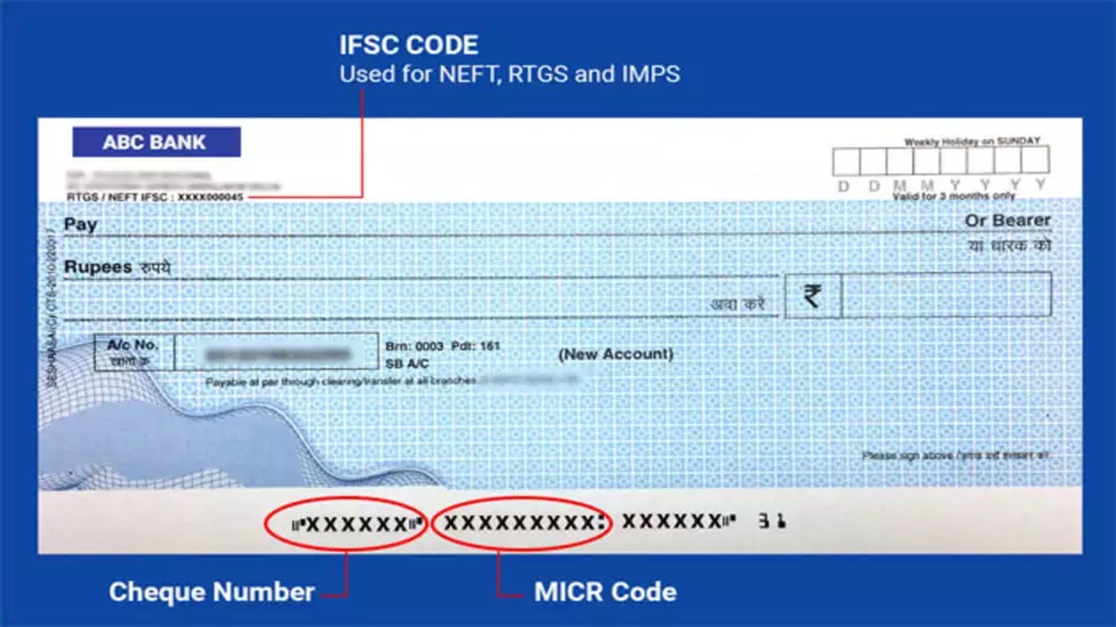

- Cheque Leaf: Printed at the top left corner near the branch address.

- Bank Passbook: Found on the front sheet, along with other account details.

- RBI Website: The RBI’s official website allows you to search for IFSC codes by bank and branch name.

- Branch Locator Tool: Many banks have an online tool to help you find IFSC codes by entering state, city, and branch details.

Important Tip: Always double-check the IFSC code during online transactions. Entering an incorrect code will result in a failed transfer.

How Does the IFSC Code Work?

Let’s understand how the IFSC code ensures smooth fund transfers:

- Step 1: Identify the Branch - Locate the recipient’s 11-digit IFSC code from their cheque, passbook, or bank website.

- Step 2: Input Details - Enter the recipient’s account number and IFSC on your bank’s app or net banking platform.

- Step 3: System Validation - The IFSC helps identify the exact bank branch.

- Step 4: RBI Monitoring - The RBI’s National Clearing Cell oversees the transaction.

- Step 5: Fund Transfer - The IFSC ensures the money is sent securely to the correct account.

Features of IFSC Codes

- Mandatory for Transfers: Essential for NEFT, RTGS, and IMPS transactions.

- Improved Security: Ensures funds reach the intended recipient securely.

- Error Reduction: Prevents wrong transactions by verifying bank and branch details.

- Monitoring by RBI: Promotes transparency and reduces fraudulent activities.

Common Methods to Transfer Money Using IFSC Code

1. National Electronic Fund Transfer (NEFT)

- Batch-wise processing of transactions.

- Suitable for non-urgent transfers.

- Requires recipient’s account details and IFSC.

2. Real Time Gross Settlement (RTGS)

- Real-time, high-value transactions.

- Funds are credited instantly.

3. Immediate Payment Service (IMPS)

- Available 24/7.

- Ideal for instant transfers via mobile banking, ATMs, or online banking

Okay, But What is MICR Code?

The MICR (Magnetic Ink Character Recognition) code is a unique identification code used by banks in India to process cheques and other financial transactions. It is a 9-digit code printed at the bottom of a cheque, which helps to identify the bank branch involved in the transaction.

The MICR code is made up of three parts:

- First 3 digits: Represent the city code

- Next 3 digits: Represent the bank code.

- Last 3 digits: Represent the unique bank branch code.

For example, the MICR code for Ujjivan’s HSR Layout Bank Branch is: 560761005, where the first three digits are the Bangalore city code, next 3 digits are bank code and last three digits are the bank branch code – code specific to HSR Layout bank branch. You can find the MICR code at the bottom of the cheque leaf (IFSC code is printed at the top of cheque leaf), at your bank branch locator tool and/or at Reserve Bank of India’s official website.

Final Thoughts

The Indian Financial System Code (IFSC) is a vital component of India’s digital banking framework. It simplifies online transactions, reduces errors, and ensures secure fund transfers. Whether you’re paying bills, shopping online, or sending money to loved ones, the IFSC code is your go-to tool for smooth banking.

Enjoy easy banking with Ujjivan Small Finance Bank. Save more with our high-interest Savings Account and Deposit products. Need cash for your business or personal needs? Apply for MSME Loans or Micro Loans with us – we offer competitive rates and quick disbursal. We also offer vehicle loans and home loans tailored for your unique requirements. Experience a smooth banking journey with Ujjivan SFB!

FAQs

1. What is the full form of IFSC?

IFSC stands for Indian Financial System Code.

2. How is an IFSC code structured?

An IFSC code has three parts: the bank code (first four letters), a zero as a separator, and the branch code (last six digits).

3. Why is an IFSC code required?

It ensures accurate and secure electronic fund transfers between bank accounts.

4. Can IFSC codes change? Y

Yes, IFSC codes may change if a bank undergoes a merger or reorganization.

5. Where can I find my bank’s IFSC code?

You can find it on your cheque book, passbook, the RBI website, or your bank’s official site.

6. What happens if I enter the wrong IFSC?

The transaction will fail, and the funds will be returned to your account.

7. Is the IFSC code the same for all branches of a bank?

No, each branch of a bank has a unique IFSC code.

8. Are IFSC codes needed for international transfers?

No, international transfers require SWIFT codes instead of IFSC.

9. Can I find an IFSC using my account number?

No, IFSC codes are branch-specific and cannot be determined using an account number alone.

10. Are IFSC codes mandatory for IMPS transactions?

Yes, an IFSC code is essential for IMPS transactions to identify the recipient’s branch.

Latest Blogs

Telangana Housing Board & KPHB Colony: A Guide to Affordable Urban Housing in Hyderabad

March 14, 2025

As Telangana continues its rapid urbanisation journey, two key housing entities—Telangana Housing Board (THB) and Kukatpally Housing Board Colony (KPHB)—have played critical roles in shaping the state's real estate ecosystem.

Does Checking CIBIL Score Frequently Lower Your Credit Points?

April 07, 2025

Imagine you're planning to apply for a home loan, a credit card, or even a car loan. Naturally, you want to ensure your CIBIL score is in good shape before proceeding.

Explained: Can NRIs Buy an Agricultural Land in India?

April 03, 2025

Real estate investment is often a top priority for Non-Resident Indians (NRIs) looking to retain strong financial ties to India.

How to Keep Your Money Growing in a Volatile Market: A Comprehensive Guide

April 15, 2025

The Indian financial landscape in early 2025 has been quite unpredictable. According to Reuters, equity mutual fund inflows slumped to an 11-month low in March 2025 due to growing concerns around sectoral imbalances and global uncertainties.

Is Closing Your Home Loan Early Good or Bad for Your Credit Score?

April 15, 2025

In the world of personal finance, owning a home is often seen as the pinnacle of financial stability.

Telangana Housing Board & KPHB Colony: A Guide to Affordable Urban Housing in Hyderabad

March 14, 2025

As Telangana continues its rapid urbanisation journey, two key housing entities—Telangana Housing Board (THB) and Kukatpally Housing Board Colony (KPHB)—have played critical roles in shaping the state's real estate ecosystem.

Does Checking CIBIL Score Frequently Lower Your Credit Points?

April 07, 2025

Imagine you're planning to apply for a home loan, a credit card, or even a car loan. Naturally, you want to ensure your CIBIL score is in good shape before proceeding.

Explained: Can NRIs Buy an Agricultural Land in India?

April 03, 2025

Real estate investment is often a top priority for Non-Resident Indians (NRIs) looking to retain strong financial ties to India.

How to Keep Your Money Growing in a Volatile Market: A Comprehensive Guide

April 15, 2025

The Indian financial landscape in early 2025 has been quite unpredictable. According to Reuters, equity mutual fund inflows slumped to an 11-month low in March 2025 due to growing concerns around sectoral imbalances and global uncertainties.

Is Closing Your Home Loan Early Good or Bad for Your Credit Score?

April 15, 2025

In the world of personal finance, owning a home is often seen as the pinnacle of financial stability.

Telangana Housing Board & KPHB Colony: A Guide to Affordable Urban Housing in Hyderabad

March 14, 2025

As Telangana continues its rapid urbanisation journey, two key housing entities—Telangana Housing Board (THB) and Kukatpally Housing Board Colony (KPHB)—have played critical roles in shaping the state's real estate ecosystem.