Ujjivan SFB is one of the India's leading small finance banks, serving the unserved and underserved segments of the population. As an aspiring mass- market bank, Ujjivan SFB offers a wide range of inclusive financial services and a personalized customer experience to its large customer base.

As a responsible bank, Ujjivan SFB believes in creating a sustainable environment and making a positive social impact. The Bank understands the importance of integrating environmental, social, and governance (ESG) factors into its operations and decision-making processes. Thus, the bank has disclosed its maiden voluntary report to disclose its sustainability performance which is a testament to transparency and accountability. It unveils a reporting framework, short, medium and long term goals, laying the foundation for future reports. Dive into our comprehensive Sustainability report to understand our commitment to a greener future.

- Sustainable banking

- Sustainable Operations

- Social Impact

- Sustainability policies & Disclosures

Ujjivan SFB aims to balance financial performance with social responsibility and environmental stewardship. The sustainability approach of the bank defines its strategy and action to align its operations with ESG trends, regulatory requirements, and stakeholder expectations. Sustainable banking practices contribute to a more resilient financial system, help address environmental and social challenges, and support the transition to a sustainable and inclusive economy.

Our sustainability framework is structured around six major pillars, each with ambitious goals that will guide our efforts over the next decade. These pillars encompass sustainable operations, empowering communities, human capital development, effective governance, customer centricity, and responsible finance. These pillars collectively reflect our commitment to responsible banking practices that contribute to a more resilient financial system and support the transition to a sustainable and inclusive economy.

Recognizing the critical link between environmental issues and sustainable development, Ujjivan places high importance on addressing challenges like human-induced climate change, water scarcity, resource consumption, and carbon emissions. In light of these issues, understanding the interconnectedness between the environment and economic considerations is crucial for long-term value creation. Ujjivan Small Finance Bank acknowledges the urgency of meeting climate commitments and, by integrating environmental sustainability into its financial operations, aims to make a significant contribution to global efforts. This approach not only enhances economic resilience but also fosters long-term value creation, benefiting both the business and the broader society.

Key Highlights

The Bank constantly strives to ensure strong corporate culture which emphasizes on integrating CSR values with business objectives. The Corporate Social Responsibility Policy (“CSR Policy”) of the Bank sets out the broad framework for guiding Bank’s CSR activities. It outlines the governance structure, operating framework, monitoring mechanism, and CSR activities that would be undertaken. The Bank has successfully implemented over 141 projects, positively impacting more than 49 Lakhs beneficiaries. During this financial year, i.e., 2022-23, 21 CSR projects were successfully implemented, and 7,30,520 lives were positively impacted.

Ujjivan SFB has been exploring the opportunities to extend its CSR activities in the low economy states - BIMARU (Bihar, Madhya Pradesh, Rajasthan, and Uttar Pradesh) and aspirational districts identified by NITI Aayog.

Key CSR highlights

The Bank has implemented all mandatory and necessary policies to enhance transparency and efficiency, underpinned by a strong governance framework involving Board of Directors and Management Committees.

To infuse ESG considerations throughout its operations, the bank has implemented a range of crucial policies, code of conduct, and guidelines that actively cultivate and uphold its commitment to responsible banking across the entire organization.

Sustainability-oriented Policies

Our Sustainability Approach

B. A. Prabhakar

Chairman

Reflecting on our sustainability journey this year, encompassing ESG aspects within our business has been enlightening. We understand where we stand currently, we recognize the positive impact...

Ittira Davis

Managing Director & Chief Executive Officer

As we embark on this journey, we take cognizance that business growth must be evaluated on the principles of triple bottom line, in that economic profits...

Sustainability framework & Approach

Ujjivan SFB aims to balance financial performance with social responsibility and environmental stewardship. The sustainability approach of the bank defines its strategy and action to align its operations with ESG trends, regulatory requirements, and stakeholder expectations. Sustainable banking practices contribute to a more resilient financial system, help address environmental and social challenges, and support the transition to a sustainable and inclusive economy.

The Bank’s sustainability framework is based on a clear understanding of the material issues identified by materiality assessment. This structured approach allows for meaningful action, transparent reporting, and continuous improvement that drives positive outcomes for the business and the broader community.

The ESG strategy of Ujjivan SFB is structured around seven pillars, each further segmented into distinct focus areas to address specific goals and targets as part of the Bank's sustainability initiatives. These pillars encompass:

Under each of these pillars, various focus areas are delineated to target specific objectives, all contributing to the overarching aim of achieving Goal 2030 in alignment with the Bank's sustainability initiatives.

For comprehensive information on each pillar of the ESG Strategy and the specific focus areas within each pillar, please refer to Ujjivan SFB Sustainability Report 2022-23.

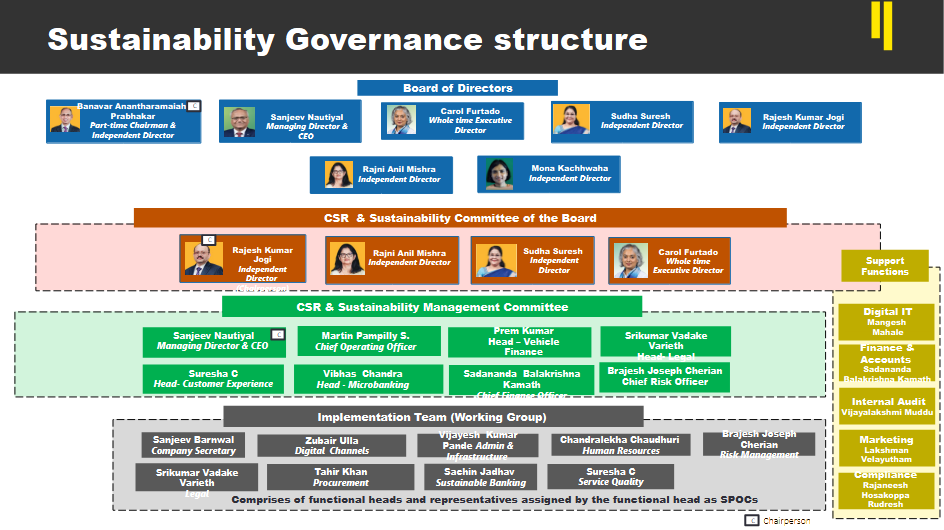

Sustainability Governance Structure

The bank has framed a sustainability governance structure with the following purposes:

This multi-tier sustainability governance structure has been designed to ensure successful integration and monitoring of Environmental, Social & Governance (ESG) principles within the Bank. This structure aims to facilitate the strategic execution of sustainable practices while providing robust oversight to ensure compliance and meaningful impact in areas related to environmental conservation, social responsibility, and ethical governance.

For details on the role of each committee of the Sustainability Governance Framework, please refer to Ujjivan SFB Sustainability Report 2022-23

Task Force for Climate related Financial Disclosures

As a recent entrant in India's banking sector, Ujjivan SFB has distinguished itself by adopting Responsible Banking as a core principle since its inception. This commitment has gained momentum in promoting financial inclusion and economic justice. Since its establishment, the bank has consistently prioritized expanding its retail exposure, with a specific emphasis on enhancing financial inclusion. Notably, Ujjivan SFB's lending and investment exposure to the top three GHG-emitting industries— transportation, electricity generation, and industry—remains negligible as of the reporting date. This strategic approach aligns with the bank's dedication to minimizing environmental impact and reinforces its focus on responsible and sustainable banking practices. While the primary focus remains on societal objectives, Ujjivan SFB recognizes the imperative of contributing to environmental management and climate change adaptation/mitigation. Aligned with the Common But Differentiated Responsibilities (CBDR) principle from the United Nations Framework Convention on Climate Change (UNFCC), the bank's initial emphasis includes expanding retail exposure while minimizing engagement in the top three GHG-emitting industries. In managing climate-induced financial risks, Ujjivan SFB adopts an 'outside-in' approach, prioritizing an understanding of how climate change can impact its investment and financing decisions.

TCFD Plans for the Future

Our Business Process Alignment to SDGs

Ujjivan SFB Activities in FY 2022-23

SDG 3: Good Health & Well-Being

The Infrastructure Development Program - Chote Kadam focuses on renovation of healthcare facilities.

In 2021-22, as part of Covid relief measures, Ujjivan SFB had initiated activities such as distribution of beds, bedspreads, oximeters, oxygen concentrators, oxygen cylinders, ITU beds, Ventilator beds, PPE kits, gloves, mask, thermal scanners, COVID safety gears for frontline workers, etc. which includes funding for 6 ITU beds to St John’s Hospital, Bengaluru and 40 D-Type oxygen cylinders to CMC Vellore.

Ujjivan Sanjeevani Kavach Program successfully executed at 478 operational areas and was able to inoculate over 80,000 vaccines through PHCs, UPHCs, Government Hospitals & privately set-up camps.

In June 2022, Ujjivan SFB organized a walkathon event for senior citizens in Ahmedabad where over 540 senior citizens participated.

Ujjivan SFB strongly supported National Road Safety Month from Jan 18 to Feb 17 2021, using social media to promote responsible road behaviour.

24x7 "Doctor on Call" teleconsultation service to support Ujjivan SFB employees and their dependents during emergencies. The program received positive feedback, with over 700 employees and their families utilizing the service.

SDG 4: Quality Education

Refurbishing and repurposing usable tablets are provided to children for educational purposes. This initiative aligns with the principles of sustainability, digital inclusion, and social responsibility.

Chote Kadam program focuses on infrastructural support for educational institutions. Through the association with Divya Nur Foundation in Bhubaneshwar, Ujjivan offered livelyhood training to 100 unemployed youth affected by Fani & Yaas cyclone in 2021-22 and successfully placed 59 of them in the retail sector such as Khadims, HDB Finance, Hunger Box, Monginis, Veggiekart, etc. The training aimed at imparting basic computer knowledge, English language skills and retail industry domain knowledge. Ujjivan SFB initiated a COVID-19 education program to raise awareness about the pandemic, offering guidance on safety measures, RT-PCR testing, government insurance schemes, and dispelling misconceptions.

SDG 5: Gender Equality

Partnering with Cheshire Disability Trust towards empowering differently abled people in Jamshedpur and Mumbai locations, the bank through its CSR initiative trained 200 candidates, of which 124 of them were placed with Square Meal foods, Quess Corp, Bellona Hospitality Services, DHL Logistics, etc. with an average monthly income of INR 12000/-

SDG 6: Clean Water & Sanitation

Chote Kadam program focuses on provision of sanitation and safe drinking water needs of the communities.

SDG 7: Affordable & Clean Energy

Chote Kadam program focuses on provision of solar-powered street lighting

SDG 8: Decent Work & Economic Growth

Ujjivan SFB offered livelihood training to 100 unemployed youth affected by Fani & Yaas cyclone in 2021-22 and successfully placed 59 of them in the retail sector such as Khadims, HDB Finance, Hunger Box, Monginis, Veggiekart, etc.

Maximize your savings! Earn up to 7.95% p.a. on our Fixed Deposits!

Book FD Online