Fixed Deposit (FD) Interest Rates

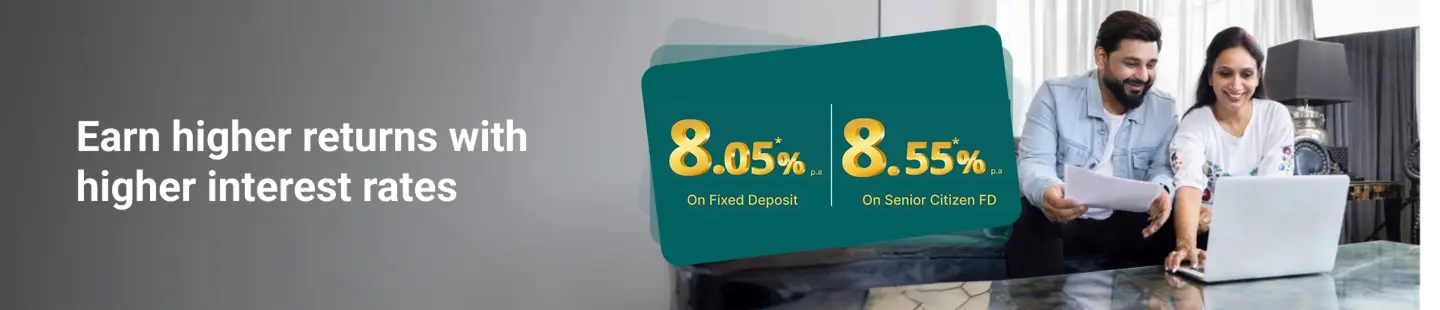

Enjoy attractive interest rates of up to 8.05% p.a.* on Fixed Deposits with Ujjivan Small Finance Bank. Senior citizens can benefit from an additional 0.50%* interest rate. Choose a tenure ranging from 7 days to 10 years and start growing your savings today. Check the latest FD rates and book your Fixed Deposit now!

Domestic Fixed Deposit and Sampoorna Nidhi Interest Rates

Ujjivan Small Finance Bank offers competitive Fixed Deposit (FD) interest rates for both general customers and senior citizens. Seniors enjoy an additional 0.50% interest rate on top of the standard FD rates. The table below provides interest rates for deposits under ₹3 crore.

Note: These Fixed Deposits are callable, allowing premature withdrawals in emergencies. 1% penalty applies if withdrawals are made within six months of deposit.

Fixed Deposit Interest Rates (Effective 24th April 2025)

| Tenure | Interest Rate (p.a.) |

|---|---|

| 7 days to 29 days | 3.75% |

| 30 days to 89 days | 4.25% |

| 90 days to 180 days | 4.75% |

| 6 months to < 12 months | 7.00% |

| 12 months to < 18 months | 7.90% |

| 18 months | 8.05% |

| 18 months 1 day to 990 days | 7.75% |

| 991 days to 60 months | 7.20% |

| 60 months 1 day to 120 months | 6.50% |

| Additional Interest Rate for Senior Citizens | 0.50% |

Disclaimer: Interest Rates are subject to change.

Platina Fixed Deposit – Domestic and NR Fixed Deposit Interest Rates

Platina Fixed Deposit is a premium product offering higher returns for deposits between ₹1 crore and ₹3 crore.

Interest Rates (Effective 24th April 2025)

| Tenure | Interest Rate (p.a.) |

|---|---|

| 12 Months < 18 Months | 8.10% |

| 18 Months | 8.25% |

| 18 months 1 day to 990 days | 7.95% |

| 991 days to 60 months | 7.40% |

Disclaimer: Interest Rates are subject to change.

NRI Fixed Deposit Interest Rates

Ujjivan Small Finance Bank offers specially curated NRI Fixed Deposits. Refer to the tables below for NRO and NRE deposit rates.

NRO Fixed Deposit Rates (Effective 24th April 2025)

| Tenure | Interest Rate (p.a.) |

|---|---|

| 7 days to 29 days | 3.75% |

| 30 days to 89 days | 4.25% |

| 90 days to 180 days | 4.75% |

| 6 months to < 12 months | 7.00% |

| 12 months to < 18 months | 7.90% |

| 18 months | 8.05% |

| 18 months 1 day to 990 days | 7.75% |

| 991 days to 60 months | 7.20% |

| 60 months 1 day to 120 months | 6.50% |

Disclaimer: Interest Rates are subject to change.

Key Points for NRO Fixed Deposit:

NRE Fixed Deposit Rates (Effective 24th April 2025)

| Tenure | Interest Rate (p.a.) |

|---|---|

| 12 months < 18 months | 7.90% |

| 18 months | 8.05% |

| 18 months 1 day to 990 days | 7.75% |

| 991 days to 60 months | 7.20% |

| 60 months 1 day to 120 months | 6.50% |

Disclaimer: Interest Rates are subject to change.

Tax Saver Fixed Deposit

The Tax Saver Fixed Deposit allows you claim tax deduction up to ₹1.5 lakh under Section 80C of the Income Tax Act, 1961.

Tax Saver Fixed Deposit Rates (Effective 24th April 2025)

| Tenure | Interest Rate |

|---|---|

| 5 years | 7.20% |

Disclaimer: Interest Rates are subject to change.

FD Calculator

Min ₹1000

Max ₹2.99Cr

Investment Summary

Invested Amount

₹ 1,000

Interest Earned

₹10,126

Interest Per Quarter

Interest Per Month

Maturity Value*

₹90,126

( Interest rates are indicative and for calculation only. Interest may be subject to TDS recovery and maturity amount may vary due to TDS impact )

Features and Benefits of Ujjivan Fixed Deposits

- Attractive interest rates with flexible tenures.

- Senior citizens earn an additional 0.5%* interest.

- Deposits insured up to ₹5 lakh under DICGC.

- Multiple pay-out options: monthly, quarterly, or maturity.

- Tailored FDs for NRIs.

- Multiple products to cater to your financial goals.

FAQs

1. What is the maximum FD interest rate?

You can earn up to 8.05%* for a 18-month FD. Senior citizens get an additional 0.50%*. Please note that interest rates are subject to change.

2. Is FD interest taxable?

Yes, FD returns are taxable as per your tax slab. TDS applies for interest earnings over ₹40,000 (₹50,000 for resident individual senior citizen) annually.

3. Can I break a Tax Saver FD early?

No, Tax Saver FDs have a mandatory 5-year lock-in period.

4. How to get highest interest on fixed deposit?

Staying invested for the long-term could help you earn higher returns. Use our FD calculator to compare tenure and returns and invest accordingly.

*T&C Apply.

#Ujjivanblogs

Latest Blogs

Catch up on the latest blog updates from your trusted bank!

Term Deposits Vs. Fixed Deposits: Know the Difference

Rohan, a young professional, is looking for a safe place to park his savings.

Top 6 Benefits of Opening a Digital Fixed Deposit

Gone are the days when opening a Fixed Deposit (FD) meant long queues, endless paperwork, and frequent bank visits.

Big Relief for Fixed Deposit Investors: Tax-Free Limit on FD Interest Hiked

Maximize your savings! Earn up to 8.55%* on our Fixed Deposits!

Book FD Online